Whose Values Count?

March 25, 2019 § 1 Comment

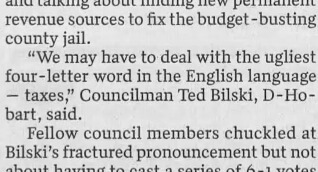

In the course of their divorce proceedings, the chancellor twice requested both Tracy and Brent Williams to submit a list of assets, values, and debts. When they came to trial, only Brent did so, and Tracy even listed the value of her business, a daycare, as unknown. The chancellor used Brent’s figures upon which to base equitable distribution. Tracy appealed, arguing that the chancellor erred in not appointing appraisers, even though she never made that request of the trial court. She argued that the valuations were not accurate due to depreciation.

The MSSC affirmed in Williams v. Williams, decided January 17, 2019. Justice Beam wrote for a unanimous court:

¶19. While we note that “expert testimony may be essential to establish valuation sufficient to equitably divide property, particularly when the assets are diverse . . . ,” Ferguson v. Ferguson, 639 So. 2d 921, 929 (Miss. 1994), we also recognize and “reiterate the principle that findings on valuation do not require expert testimony and may be accomplished by adopting the values cited in the parties’ 8.05 financial disclosures, in the testimony, or in other evidence.” Horn v. Horn, 909 So. 2d 1151, 1165 (Miss. Ct. App. 2005) (quoting Ward v. Ward, 825 So. 2d 713, 719 (Miss. Ct. App. 2002)).

¶20. Here, the record reflects that only Brent attempted to provide the chancellor with evidence regarding the valuations of the parties’ business interests, and the chancellor used those valuations as reflected in her opinion. Tracy’s argument that the chancellor committed reversible error by not appointing experts to appraise the current valuations due to depreciation is without merit. This Court refuses to blame the chancellor for a party’s failure to present sufficient evidence of property valuation. Faced with similar circumstances, we stated the following in Dunaway v. Dunaway:

It is our conclusion that the chancellor, faced with proof from both parties that was something less than ideal, made valuation judgments that find some evidentiary support in the record. To the extent that the evidence on which the chancellor based his opinion was less informative than it could have been, we lay that at the feet of the litigants and not the chancellor. The chancellor appears to have fully explored the available proof and arrived at the best conclusions that he could, and we can discover no abuse of discretion in those

efforts that would require us to reverse his valuation determinations. Dunaway v. Dunaway, 749 So. 2d 1112, 1121 (Miss. Ct. App. 1999). As explained in Dunaway, the chancellor’s duty is not to obtain appraisals of the marital property. Id. Further, the Dunaway court found that, while expert testimony about property valuations might be helpful in some cases, it is not required, and the chancellor may consider other

evidence presented by the parties. Id.

¶21. Tracy did not come forth with expert testimony or any other valuations of the businesses; therefore, the chancellor used the available proof, including Brent’s valuations, and arrived at the best conclusion that she could. Accordingly, this Court finds the chancellor did not err in the valuation of the Williams’s business interests.

I’ve said it here before that it’s often breathtaking how little attention lawyers give to adequate proof of values in divorce cases. That forces judges to do their dead-level best with scanty evidence. It can leave your clients disappointed in the outcome at the least, and mad as a hornet at you at the worst.

It’s malpractice in a divorce case to merely accept your client’s 8.05 as scribbled out by her without going over it and questioning every item, or at least the ones that appear out of line, and without making sure it is complete, with values and itemization of debt.

In this district, as the judge in this case did, we require an asset table showing the parties’ values, designation as marital or non, and debt. The list must be consolidated, meaning that there is one list. That way the judge is not required to figure out whether the “green sofa, $600” on her list is the same as the “couch in living room, $2,000” on his list are the same thing. We also will not give you a trial setting unless and until you produce that list. In cases where one party decides not to participate in that exercise, we accept the unilateral list and proceed to trial.

Reprise: Handling the Insolvent Estate

March 22, 2019 § Leave a comment

Reprise replays posts from the past that you might find useful today.

INSOLVENT ESTATES

January 13, 2011 § 4 Comments

When the debts and expenses of the estate exceed the value of its assets, the estate is said to be insolvent, and there is a procedure for adjudication of insolvency, satisfaction of creditors, and payment of administration expenses that is spelled out in MCA § 91-7-261 through -268.

The estate is insolvent when its debts and the expenses of administration exceed the value of the real property and the other property that is not exempt. You can find out more about exempt property here.

Either the administrator or a creditor may petition the court to adjudicate its insolvency.

MCA § 91-7-261 sets out the procedure to determine insolvency. The administrator is required to “take proper steps speedily to ascertain whether the estate be solvent or insolvent.” If the administrator finds that the estate is insolvent, she files a “true account” itemizing all of the personal estate, assets of every description, the land of the deceased, and all of the deceased’s debts. Notice is given to the devisees or heirs, and the matter is presented to the court for hearing. If the court determines from the account that the estate is indeed insolvent, the chancellor will order that the assets be sold and that the expenses of ” … the last sickness, the funeral, and the administration, including the commissions …” are first paid out of the proceeds,” and that any remaining proceeds be divided among the creditors ” … in proportion to the sums due and owing them respectively …”

The procedure for distribution of remaining proceeds among the creditors is provided in MCA § 91-7-269. After the time to probate claims has elapsed, a notice is published for three consecutive weeks in a newspaper published in the county that the claims against the estate will be taken up by the court on a day and at a time certain, that any and all claims not required by law to be probated shall be filed with the clerk by a stated date, and that all creditors may attend. A hearing is held at which the administrator may object to any claim, evidence is presented pro and con, and the court may either allow it in whole or in part, or reject it in whole or in part. The administrator may file a verified application to be reimbursed for claims paid prior to the adjudication of insolvency, and the court shall treat them as if they had been properly probated.

MCA § 91-7-271 provides that the allowed claims shall be paid pro rata, and any creditor not paid within ten day of the court’s order shall have execution against the executor or administrator and the sureties on his bond.

Any suit pending against the executor or administrator at the time of insolvency does not abate, but may be prosecuted to final judgment, according to MCA § 91-7-273, but -274 bars suits from being filed after the estate is declared insolvent. You should read -273 carefully for the effect of and payment of a judgment against the estate for suits that were pending when the insolvency is determined.

Blueprint for Proving Fraud on the Court

March 20, 2019 § 2 Comments

If you will type “fraud on the court” in that Search box over there on the right at the top of the page, you will call up some posts I have done on the effect that fraud on the court has on a judgment.

Most fraud-on-the-court situations are pretty clear. Sometimes, though, you have to convince the judge that the behavior about which you are complaining did constitute a fraud on the court even though it appears benign on its face. Your burden of proof is clear and convincing, so you have to make sure the evidence is strong.

In Manning v. Tanner, 594 So.2d 1164, 1167 (Miss. 1992), the MSSC established four factors that the court must find in order to vacate a judgment for fraud on the court:

(1) that the facts constituting the fraud, accident, mistake, or surprise must have been the controlling factors in the effectuation of the original decree, without which the decree would not have been made as it was made;

(2) the facts justifying the relief must be clearly and positively alleged as facts and must be clearly and convincingly proved;

(3) the facts must not have been known to the injured party at the time of the original decree; and

(4) the ignorance thereof must not have been the result of the want of reasonable care and diligence.

Clearly factor 1 is the most important to the analysis. If the allegedly fraudulent conduct would not have effected the outcome, the relief should not include setting aside the judgment. To illustrate: I set aside an irreconcilable differences divorce once because on a R60 hearing a year later emails were produced in which the parties essentially agreed that the PSA presented to the court was a sham, and that they were actually agreeing to terms that an attorney had told them I would never approve. Had I known of the side deal when I was presented the original judgment I would never have signed it.

Factor 2 mentions pleadings. Remember the requirement of R9(b) that “the circumstances constituting fraud … shall be stated with particularity.” You have to state in your motion what the specific conduct was that you claim was fraudulent. And, again, the conduct must be proven by clear and convincing evidence.

If your client knew, or should have known by reasonable care and diligence, of the fraud, then the court should not set aside the judgment. That’s Factors 3 and 4.

In deciding whether to set aside a judgment for fraud on the court, the chancellor must keep in mind that “Relief based on ‘fraud upon the court’ is reserved for only the most egregious misconduct, and requires a showing of ‘an unconscionable plan or scheme which is designed to improperly influence the court in its decision.’” Wilson v. Johns-Manville Sales Corp., 873 F.2d 869, 872 (5th Cir. 1989). “The mere non[-]disclosure to an adverse party and to the court of facts pertinent to a controversy before the court does not add up to ‘fraud upon the court’ for purposes of vacating a judgment under Rule 60(b).” Trim v. Trim, 33 So.3d 471, 477-78 (Miss. 2010). “To warrant relief pursuant to Rule 60(b)(1) the movant must prove fraud, misrepresentation or other conduct by clear and convincing evidence.” Hill v. Hill, 942 So.2d 207, 214 (Miss. App. 2006) [My emphasis].

How Not to do a R81 Summons

March 19, 2019 § Leave a comment

It should go without saying that the chancellor may not proceed unless and until she has personal jurisdiction over the defendant or respondent. If process is defective, there is no personal jurisdiction, and any action the chancellor takes is of no effect.

That principle came painfully into play when Nancy Edwards sued her ex, Johnny Edwards, for contempt and modification. After hearing the matter, the chancellor found Johnny in contempt, ordered him to do certain acts to purge himself of contempt, and directed a review hearing. A R81 summons was issued directing him to appear at a stated date and time “in the courtroom of the Oktibbeha County Courthouse at Columbus, Mississippi.” When the matter came before the judge and Johnny did not appear, the court found him in contempt and granted other relief. Johnny appealed.

The COA reversed and remanded in Edwards v. Edwards, decided February 12, 2019. Chief Judge Barnes wrote for the unanimous court sitting en banc:

¶9. The first assignment of error raised on appeal is that the summons was defective. As noted, the summons directed Johnny to appear on May 15, 2017, at the “Oktibbeha County Courthouse at Columbus, Mississippi.” (Emphasis added). The Oktibbeha County Courthouse is in Starkville, Mississippi, not Columbus. Columbus is located in Lowndes County. “[A] court may take judicial notice that a city is in a particular county.” Russell v. State, 126 So. 3d 145, 148 (¶8) (Miss. Ct. App. 2013). The record also indicates that the chancery court conducted hearings in various counties throughout its district, including Oktibbeha, Lowndes, and Chickasaw.

¶10. Rule 81 mandates that in certain actions, such as contempt, “special notice be served on a respondent for a hearing with a date, time[,] and place specified.” Bailey v. Fischer, 946 So. 2d 404, 406 (¶7) (Miss. Ct. App. 2006); see also Sanghi [v. Sanghi], 759 So. 2d [1250] at 1256 (¶28) [(Miss. App. 2000)] (The only required information for a summons under Rule 81 “is that a party is to be told the time and place for the hearing and that no answer is needed.”). In Caples v. Caples, 686 So. 2d 1071, 1074 (Miss. 1996), the Mississippi Supreme Court found notice issued to a respondent was defective and “inconsistent with Rule 81,” even though the respondent made an initial appearance, because the notice did not contain the time and place of the hearing and required a written response to the complaint.

¶11. In this instance, the Rule 81 summons failed to specify the correct place for the hearing. [Fn omitted] Reviewing the notice, Johnny would not have known whether to appear at the Oktibbeha County Courthouse in Starkville or the Lowndes County Courthouse in Columbus. Therefore, finding the notice was defective under Rule 81, we reverse the judgment and remand for further proceedings.

An unmentioned corollary is that close is not good enough when it comes to process. The process on its face must comply in every particular with R81 (or R4 if that governs the action in which you are proceeding), and “substantial compliance” is not adequate. The only cure for defective process is voluntary appearance of and participation by the summoned party without objection to personal jurisdiction.

Resource for Interpreters

March 18, 2019 § Leave a comment

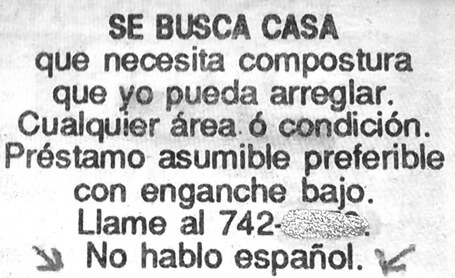

When you need an interpreter for court, it’s a critical need, indeed. Without one key testimony might be entirely inaccessible.

The AOC is responsible for training and certifying interpreters. As the AOC website explains:

Many people living in Mississippi readily read, speak, and understand English. There are many others living in Mississippi for whom English is not their primary language and for whom English is not readily understood. For those limited English proficiency (LEP) individuals, understanding and exercising their legal rights may be difficult and could result in the denial of any meaningful access to the justice system.

Court interpreters must possess specialized skills that very few bilingual individuals possess. The Mississippi Administrative Office of Courts (AOC) became a member of the Consortium for Language Access in the Courts of the National Center for State Courts in order to gain access to other professionals in the field of Court interpreting. The Administrative Office of Courts has developed the Mississippi Court Interpreter Credentialing Program, based on model policies promulgated by the Consortium, in order to assist the courts in Mississippi in their endeavor to provide equal access to justice for limited English proficiency individuals. This program will train, certify, and test individuals who wish to serve as interpreters in the courtrooms of Mississippi. The AOC adopted the Code of Ethics for Court Interpreters and the Rules on Standards for Court Interpreters on October 17, 2011.

The AOC court interpreter web site is at this link. Or, you clan click the AOC tab on the Mississippi Judiciary website.

Whom to appoint as interpreter is within the discretion of the trial court. AOC suggests that candidates be considered in this order: (1) Certified, meaning that the person has been found to have the requisite skills, has undergone training in courtroom techniques and ethics, and has been certified; (2) Registered, meaning that the person has applied for certification but has not completed the process; and Non-credentialed, meaning that the person is neither certified nor registered.

Changing Rule 81

March 15, 2019 § 5 Comments

As I did last month, I invite your comments and suggestions as to how MRCP 81 might be amended to improve its performance. Or maybe you think it’s fine as is. Please comment and let me know your thoughts.

The MSSC Advisory Committee on Civil Rules is combing through the MRCP to suggest amendments. Your thoughts as practitioners and judges will be helpful in the process.

A Less-Than-Final Judgment

March 13, 2019 § Leave a comment

The chancellor takes custody away from your client and awards it to the maternal grandmother, who had pled not only for custody, but also for child support.

On the latter issue the judge held “the issue of child support to be paid by [the natural parents] in abeyance,” and allowed for a review hearing on the issue of child support after six months.

You file a R59 motion, which is denied.

Your client wants to appeal. When do you appeal? (A) Now? (B) Some time after six months? (C) After the court finally rules on child support? (D) When the child has his first holy communion?

The answer is (C), because you can only appeal from a final judgment or from a less-than-final judgment only when the court certifies that there no just reason for delay and directs entry of a final judgment. That’s MRCP 54.

The above scenario is from the COA’s decision in Britt v. Holloway, decided January 15, 2019, in which the court dismissed the appeal for lack of jurisdiction.

The law can sometimes seem to be filled with snares and traps for the unwary, so it is understandable that lawyers sometimes jump into an appeal even when there is no final judgment simply to escape the terror of being too late to appeal.

Oh, and before we leave this, that reference above to holy communion was a red herring. I thought you might want to know.

PSA No-No’s

March 12, 2019 § Leave a comment

Just because your client agrees with her estranged husband to certain terms for settlement of their divorce does not mean that you should plug those terms into a PSA and shove it under the judge’s nose for approval along with a divorce judgment. Our appellate courts have held that some provisions are void and unenforceable as contrary to public policy. Here are the most notable:

- A provision that relocation of the custodial parent would automatically trigger a change of custody without court action is void because it deprives the chancery court of jurisdiction to modify its judgment. McManus v. Howard, 569 So.2d 1213, 1216 (Miss. 1990).

- Likewise, an agreement that the custodial parent may not relocate without prior court approval is void. Bell v. Bell, 572 So.2d 841, 845-46 (Miss. 1990).

- The parties may not agree that child support terminates when the child turns 18. Lawrence v. Lawrence, 574 So.2d 1376, 1381 (Miss. 1991).

- A post-nuptial agreement that the father would automatically have custody of the parties’ child in the event of a separation was held to be unenforceable. McKee v. Flynt, 630 So.2d 44, 50 (Miss. 1993).

- A mother’s agreement to forego child support in return for a deed to some property was void as against public policy. Calton v. Calton, 485 So.2d 309, 310 (Miss. 1986).

- The parties’ agreement that the mother would pay no child support if she agreed to transfer custody to the father is unenforceable. R.K. v. J.K., 946 So.2d 764, 779-80 (Miss. 2007).

It should go without saying that the chancellor, before approving the agreement, must find that it makes adequate provision for the support and custody of the child(ren). MCA § 93-5-2(2). The court reversed in a case where the mother agreed to no visitation whatsoever and to a provision that her payment of child support was in an amount she could not afford. Lowrey v. Lowrey, 919 So.2d 1112, 1119 (Miss. 2005).

An agreement for no child support should be approved only in the most exceptional circumstances, such as unemployment. Brawdy v. Howell, 841 So.2d 1175, 1179 (Miss. App. 2003).

It is against public policy for the parties to present one agreement to the court for approval while having a secret agreement that they would not abide by its terms. Wilburn v. Wilburn, 991 So.2d 1185, 1193 (Miss. 2008). I set aside a divorce judgment on its first anniversary after I was presented proof in court that the parties had exchanged emails in the course of settlement negotiations that the husband promised he would not enforce the wife’s obligation to pay certain debts under the agreement if she would agree that he did not have to pay the child support provided for. Oh, and the agreement for her to pay certain debts was only in the agreement to help her qualify for a low-income mortgage.

Keep in mind that our appellate courts have been reversing cases in which the paying party was ordered to maintain life insurance in a benefit amount in excess of the total obligation. In one case, the trial court ordered the ex-husband to maintain a $1,000,000 life insurance policy to secure a $480,000 lump sum alimony award. The COA reversed, holding that the amount of life insurance may only be enough to secure the award. Griner v. Griner, 235 So.3d 177, 188-89 (Miss. App. 2017). Your PSA’s should follow that line of reasoning or reflect some other justification for the agreed amount.

Agreements Against Public Policy

March 11, 2019 § Leave a comment

In a recent case, the COA was confronted with the question whether an agreement between the parties for lump-sum child support, incorporated into an irreconcilable differences divorce judgment, was enforceable. Lump sum child support is not allowable in Mississippi. Pittman v. Pittman, 909 So.2d 148, 152-53 (Miss. App. 2005). All of the authorities on Mississippi family law agree.

Kevin McCall filed a petition to modify his lump sum child support and added a R60 motion arguing that the provision was void as against public policy.

In McCall v. McCall, a January 29, 2019, decision, the COA ruled that the issue was no properly before the court because Kevin McCall had never appealed the 2014 divorce judgment that approved the agreement (interesting question: how does one appeal from an agreed judgment?). The opinion, penned by Judge Griffis, went on to add:

¶20. … Instead, this Court recognizes that “property settlement agreements are contractual obligations.” In re Estate of Hodges, 807 So. 2d 438, 442 (¶20) (Miss. 2002). The provisions of a property-settlement agreement executed prior to the dissolution of marriage must be interpreted by courts as any other contract. Id. at 445 (¶26). In East v. East, 493 So. 2d 927, 931-32 (Miss. 1986), the supreme court held that “[a] true and genuine property settlement agreement is no different from any other contract, and the mere fact that it is between a divorcing husband and wife, and incorporated in a divorce decree, does not change its character.” [Fn omitted]

¶21. Although this Court does not authorize the award of lump sum child support, we recognize that circumstances may arise between divorcing parties, such as here, where the divorcing parties may determine that there is a just and a reasonable basis for a non-custodial parent to agree to pay the custodial parent a lump sum amount to satisfy child support obligations.

In a dissent, Judge McCarty took the position that the agreement was void as against public policy, and that the issue was properly before the COA via the R60 motion. Judge Westbrooks joined in the dissent.

It is well-settled in our law that the parties may agree to terms in an irreconcilable differences divorce that no judge could order in a contested case. For instance, they may agree that support for the child will continue beyond age 21, or that child support will exceed the guidelines. Or they may agree to forms of alimony that no judge could order. They may agree that lump sum alimony terminates on death.

It’s difficult to determine where the line is between what the chancellor may approve and what is void whether the chancellor approves it or not. I’ll post some thoughts tomorrow on provisions that our appellate courts have held to be unenforceable.