IF BUSINESS IS SLACK, YOU MIGHT TRY CHANNELING

November 19, 2010 § Leave a comment

Channeling is communication with spirits. Some people claim to be able to communicate with the dead or others in the spirit realm, and share the communications with those here on the terrestrial plane.

That’s what an Arizona lawyer did. She convinced at least one client that she could “channel” messages from his dead spouse in the deceased spouse’s estate. She told the client that she was receiving communications from the deceased directing them to take this action and that, and she was so convincing that she continued to represent the client for three years.

Things got a little more complicated after she persuaded her client that his deceased spouse wanted the attorney and client to have sex, and they did. The client filed a bar complaint charging that the lawyer was exercising undue influence.

You can read what the Arizona courts did discipline-wise here.

Now, I am not suggesting you carry channeling beyond the bounds of propriety, assuming that channeling is itself, after all, within the bounds of proriety.

I am merely mentioning another possible career enhancement, not too far removed from the common practice of Mississippi lawyers to try to predict what the chancellor will do by hitting the ouija board with their clients. Uh, most of you still do that, right?

If you are going to get into the channeling business, please try to make it obvious to the court that your behavior is channeling and not imbibing.

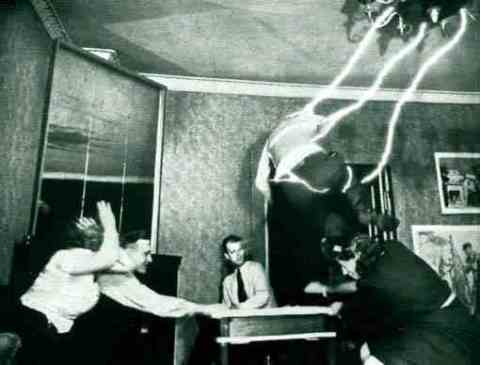

And another thing you need to keep in mind: there are risks involved in channeling. There is always the danger of out-of-control séances:

SWEEPING DUSTBUNNIES

November 18, 2010 § 2 Comments

Have you ever noticed that mistakes and missteps seem to pile up in some cases despite your best efforts, just like those dustbunnies that pile up under that buffet in your dining room no matter how hard you try?

The case of Estate of Bellino v. Bellino, decided by the Court of Appeals on November 2, 2010, is one of those “dustbunny” cases, and it merits your attention. For ease of following this, we’ll mark the dustbunnies as they accrue with the international dustbunny symbol: ¤.

Stephen and Margaret Bellino were married in 1974. During the marriage, Stephen inherited $200,000 and opened a securities account with A. G. Edwards (AGE). In 1995, he and Margaret executed a joint account agreement declaring the account to be a joint tenancy with right of survivorship.

Alas, the marriage foundered, and the erstwhile blissful couple faced off in court. Their marriage ended May 2, 2006, with entry of a final judgment of divorce.

And that is when the discombobulating deluge of dustbunnies (¤) began to develop.

It seems that the divorce judgment made no mention of the AGE account. That would be the first ¤.

Stephen became aware of the problem when he tried to make a withdrawal and was refused by AGE, which took the position that it could not allow any withdrawals until the court addressed the ownership issue. Another ¤.

Stephen filed an MRCP Rule 59 motion to alter or amend the judgment to address the oversight. Only problem is that he waited until May 15, 2006. That would be a major ¤ because it was filed more than ten days after entry of the judgment, and so the motion was time-barred.

In all the hubbub surrounding the issue, Stephen never got around to changing ownership of the account. This is one of those ¤’s that spawns lots of other ¤’s.

Before the issue could be resolved by the judge, Stephen died on June 18, 2006. Regrettable as it is, this development was also a ¤.

Stephen’s estate was duly opened in July. There is no mention of the estate being substituted as a party in the divorce action under MRCP 25. Probably a ¤.

In November, the attorney for the estate approached the chancellor and, without any notice to Margaret or her attorneys, obtained an order directing AGE to pay the funds to the estate. No question this was a ¤.

To compound matters, the attorney for the estate never filed the order (or, it appears, any motion therefor) in either the estate or divorce file, and never served it on Margaret’s attorneys. That would be ¤ ¤ ¤.

They’re beginning to pile up, aren’t they?

The chancellor set aside the order (he was likely not happy with the way it had been handled) and eventually ruled that the account was Margaret’s. A ¤.

At this point the attorney for the estate realized that the dustbunnies were getting out of hand, so he started trying to sweep them up. The problem is that when you sweep dustbunnies it tends to scatter them and they seem to proliferate, which is exactly what they did.

The attorney for the estate filed an appeal. Now, this is really a dustbunny because the issues are fairly straightforward and not really in doubt. Score another ¤.

Right off the bat the court of appeals criticized the attorney for the estate for not filing a statement of issues after being asked not once but several time by the appellate court to do so. That would be another ¤ ¤ ¤. The court even thought about not considering his brief, which is, of course a ¤.

The court of appeals ruled that Margaret got the money because Stephen never changed the account and it was hers by survivorship. A predictable ¤.

Stephen’s estate will be stuck with the cost of cleaning up all these dustbunnies, and will have nothing to show for it. That’s a ¤ right there. In the alternative, the estate could insist that its attorney bear the cost of the appeal, which would be his own personal ¤.

So there you have it. Too many dustbunnies and before you know it you have a mess too big to clean up.

JUDGE ROBERTS’ PRIMER ON ADVERSE POSSESSION

November 17, 2010 § 3 Comments

In the case of Dean vs. Slade, et al., rendered November 9, 2010, Judge Larry Roberts of the Court of Appeals laid out a template of authority you should keep on hand for your next adverse possession case. Although the decision does not touch on all of the adverse possession factors, it touches on some important authority that you can use to your advantage. I simply stripped the material below right out of Judge Roberts’ opinion, making a couple of minor editorial changes.

THE ADVERSE POSSESSION FACTORS

MCA § 15-1-13(1) (Rev. 2003) provides the following: Ten (10) years’ actual adverse possession by any person claiming to be the owner for that time of any land, uninterruptedly continued for ten (10) years by occupancy, descent, conveyance, or otherwise, in whatever way such occupancy may have commenced or continued, shall vest in every actual occupant or possessor of such land a full and complete title[.] Thus, the party claiming adverse possession must prove by clear and convincing evidence that his/her possession was “(1) under claim of ownership; (2) actual or hostile; (3) open, notorious and visible; (4) continuous and uninterrupted for a period of ten years; (5) exclusive; and (6) peaceful.” Stringer v. Robinson, 760 So. 2d 6, 9 (Miss. Ct. App. 1999) (citing Rice v. Pritchard, 611 So. 2d 869, 871 (Miss. 1992)). “The ultimate question is whether the possessory acts relied upon by the would be adverse possessor are sufficient enough to place the record title holder on notice that the lands are under an adverse claim of ownership.” Id. (citing Johnson v. Black, 469 So. 2d 88, 90-91 (Miss. 1985)).

THE EVIDENTIARY STANDARD

Clear and convincing evidence has been defined as follows: that weight of proof which produces in the mind of the trier of fact a firm belief or conviction as to the truth of the allegations sought to be established, evidence so clear, direct and weighty and convincing as to enable the fact-finder to come to a clear conviction, without hesitancy, of the truth of the precise facts of the case. Moran v. Fairley, 919 So. 2d 969, 975 (Miss. Ct. App. 2005) (quoting Travelhost, Inc. v. Blandford, 68 F.3d 958, 960 (5th Cir. 1995)). “Clear and convincing evidence is such a high standard [of proof] that even the overwhelming weight of the evidence does not rise to the same level.” Id. (citing In re C.B., 574 So. 2d 1369, 1375 (Miss. 1990)).

CONFLICTING EVIDENCE

Absent a finding of an abuse of discretion or manifest error, a chancellor is the sole judge of the credibility of witnesses and the weight to give to the evidence. Webb v. Drewrey, 4 So. 3d 1078, 1081 (Miss. Ct. App. 2009).

ACTUAL OR HOSTILE

“Actual possession is ‘effective control over a definite area of land, evidenced by things visible to the eye or perceptible to the senses.’” Warehousing Mgmt., LLC v. Haywood Props., LP, 978 So. 2d 684, 688 (Miss. Ct. App. 2008) (quoting Wicker v. Harvey, 937 So. 2d 983, 993-94 (Miss. Ct. App. 2006)). The adverse possessor must hold the property without the permission of the true title owner since “permission defeats adverse possession.” Gillespie v. Kelly, 809 So. 2d 702, 706-07 (Miss. Ct. App. 2001) (citing Myers v. Blair, 611 So. 2d 969, 971 (Miss. 1992)). “Adverse use is defined as such a use of the property as the owner himself would exercise, disregarding the claims of others entirely, asking permission from no one, and using the property under a claim of right.” Peagler v. Measells, 743 So. 2d 389, 391 (Miss. Ct. App. 1999) (quoting Cummins v. Dumas, 147 Miss. 215, 113 So. 332, 334 (1927)).

OPEN, NOTORIOUS AND VISIBLE

The mere possession of land is not sufficient to satisfy the requirement that the adverse possessor’s use be open, notorious, and visible. Wicker, 937 So. 2d at 994 (citing Craft v. Thompson, 405 So. 2d 128, 130 (Miss. 1981)). A claim of adverse possession cannot begin unless the landowner has actual or constructive knowledge that there is an adverse claim against his property. Scrivener v. Johnson, 861 So. 2d 1057, 1059 (Miss. Ct. App. 2003) (citing People’s Realty & Dev. Corp. v. Sullivan, 336 So. 2d 1304, 1305 (Miss. 1976)). “[A]n adverse possessor ‘must unfurl his flag on the land, and keep it flying, so that the (actual) owner may see, and if he will, [know] that an enemy has invaded his domains, and planted the standard of conquest.’” Wicker, 937 So. 2d at 994(citing Blankinship v. Payton, 605 So. 2d 817, 820 (Miss. 1992)).

DO I NEED TO FILE A MOTION FOR A NEW TRIAL TO PROTECT MY RIGHT TO AN APPEAL?

November 16, 2010 § Leave a comment

Unlike the practice in Circuit Court, where a motion to set aside the verdict and for a new trial is a prerequisite to the right to appeal, it has never been the rule in Chancery Court that a motion for reconsideration or for a new trial or for relief from judgment operate in the same fashion. In two opinions issued last year (I have not taken the time to dig them up, but they are out there), our appellate courts commented that no motion for a new trial had been filed by the appellant before taking appeal from Chancery. It raised a question in my mind whether we were poised to go in a new direction.

MRCP Rule 52(b) would seem to dispose of the matter, although I do not recall it being mentioned in the appellate decisions mentioned above. It states:

When findings of fact are made in actions tried by the court without a jury, the question of the sufficiency of the evidence to support the findings may thereafter be raised regardless of whether the party raising the question has made in court an objection to such findings or has filed a motion to amend them or a motion for judgment or a motion for a new trial.

Of course, the question of sufficiency of fact to support the findings is only one possible basis of appeal. One may also appeal on the ground that the decision of the Chancellor is contrary to the law, or that there is a defect in personal jurisdiction (subject matter jurisdiction may be questioned for the first time at any point). Is a motion necessary to preserve those points?

Without doing substantial research, I can only say that in my years of practice I never saw a case where an appeal from Chancery Court was rejected for failure to file a motion for a new trial. Your mileage may vary.

EVENTS THAT TERMINATE GUARDIANSHIPS

November 15, 2010 § 2 Comments

We’ve already discussed how to close a guardianship, but what exactly are the events that trigger closing it?

MCA § 93-13-75:

The powers of a guardian for a minor cease when the ward attains the age of 21.

The chancellor may, in his or her discretion, terminate the guardianship after the ward attains the age of 18.

When the funds and personal property of the ward do not exceed $2,000, and there is no prospect of further funds coming into the guardianship, the court may terminate the guardianship and may impose conditions and restrictions for the deposit and expenditure of the funds. This provision applies not only to guardianships for minors, but also to guardianships for a “person of unsound mind, or convict of felony.”

MCA § 93-13-125:

In a guardianship for a person of unsound mind but not “properly adjudged mentally unsound,” the court may terminate the guardianship “If at any time it be made to appear to the satisfaction of the court that such person has been restored to sanity, such guardianship may be terminated and ended as now provided by law.”

MCA § 93-13-133:

If the court is satisfied that a person of unsound mind is restored to sanity, or that an habitual drunkard, or habitual user of cocaine, or opium or morphine has “sufficiently reformed to justify it …” the court may terminate the guardianship.

MCA § 93-13-135:

The guardianship of a convict of felony ceases when the term of imprisonment expires or the convict dies.

MCA § 93-13-151:

Guardianship of a person who is found in need of mental treatment shall end when the ward is “restored to reason” and is so adjudicated by a court of competent jurisdiction.

MCA § 93-13-161:

If a guardian has been appointed for the estate of a person in the armed forces or a merchant seaman who is “officially reported or listed as missing in action, or interned in a neutral country, or beleagured, besieged, or captured by an enemy,” the guardianship may be terminated as follows:

At any time upon petition signed by the absentee, or on petition of an attorney-in-fact acting under power of attorney granted by the absentee, the court shall direct the termination of the guardianship and the transfer of all property held thereunder to the absentee or the designated attorney-in-fact. Likewise, if at any time subsequent to the appointment of a guardian it shall appear that the absentee has died and an executor or administrator had been appointed for his estate …”

MCA § 93-13-77:

” … it shall be made the duty of an executor or administrator of a deceased guardian to make final settlement in a of their testator’s or intestate’s guardianship accounts in the chancery court in which the same mey be pending …”

It is obvious that a guardianship terminates on death of the ward. In such a case, an estate should be opened, a final accounting filed and noticed, and the assets transferred to the estate once the guardianship is closed.

A guardianship solely of the person terminates on emancipation of the ward, or when it is shown to the court no longer to be necessary.

RIBOLLITA

November 14, 2010 § 4 Comments

Several years ago, Lisa and I found ourselves on a frigid, windy November day in the Piazza della Signoria in Florence. The icy wind that knifed through our wool coats was the tramontana — the swift, cold downdraft from the snow-covered Alps to the north that sweeps across Tuscany and sends sightseers indoors in search of some warmth. It was lunch time, and a break from the brisk cold was in order.

And so we made our way into a cozy restaurant with a warm fireplace off the historic square, where we asked our waitress for a recommendation. Without hesitation, she suggested we have the ribollita, a hearty Tuscan minestrone or vegetable soup thickened with stale bread. “Ribollita” means “reboiled” in Italian, and refers to the fact that the soup is usually made the day before or earlier in the day and is reboiled for serving. We found that this delicious, smoky soup chased away the chill, and I made sure to get the recipe. Alas, I lost it and the name of the ristorrante before I could record them, but this recipe is as close to the original as I could find.

Now that the temperatures are dropping and the days are growing shorter, do yourself a favor and make a nice pot of this soup. Pour yourself a glass of hearty Montefalco Rosso or a Chianti Classico and sit by the fire. This soup is cold-weather comfort food par excellence.

RIBOLLITA

1/4 cup extra-virgin olive oil, plus some for drizzling on bread

1 onion, chopped

1 carrot, chopped

4 ounces pancetta, chopped

2 cloves garlic, 1 minced and 1 whole

1 teaspoon salt

1 teaspoon freshly ground black pepper

1 tablespoon tomato paste

1 (15-ounce) can diced tomatoes

1 pound frozen spinach, thawed and squeezed dry

1 (15-ounce) can cannelloni beans, drained

1 tablespoon herbs de Provence

3 cups chicken stock

1 bay leaf

1 (3-inch) piece Parmesan rind

4 to 6 ciabatta rolls, halved lengthwise, or 1 loaf Italian bread or ciabatta, sliced on the bias

Grated Parmesan, for serving

Heat the oil in a heavy large pot over medium heat. Add the onion, carrot, pancetta, minced garlic, salt, and pepper. Cook until the onion is golden brown and the pancetta is crisp, about 7 minutes. Add tomato paste and stir until dissolved. Add tomatoes and stir, scraping the bottom of the pan with a wooden spoon to release all the brown bits. Add the spinach, beans, herbs, stock, bay leaf, and Parmesan rind. Bring the soup to a boil, reduce heat and simmer for 30 minutes.

Meanwhile, preheat the oven to 350 degrees F.

Drizzle the ciabatta halves or bread slices with olive oil. Toast until golden brown, about 5 minutes. Remove from the oven and rub the top of the toasts with the whole garlic clove. Place the toasts in the serving bowls and ladle the soup over the toasts. Sprinkle with Parmesan and serve immediately.

AN ALIMONY TAX CONSEQUENCE YOU NEED TO CONSIDER

November 12, 2010 § Leave a comment

Internal Revenue Code § 71(f), provides that when alimony payments last three years or less, they will not likely be treated as tax deductible, even if the divorce judgment specifically states that they are deductible.

You need to talk this over with a CPA to get some guidance before you draft your PSA or have your client testify, for example, that she wants 24 months of rehabilitative alimony. This is one of those “tax consequences” of the award that is one of the Armstrong factors that the court is supposed to consider. If you don’t put evidence in the record about it, you won’t have to worry about it because the trial judge simply won’t give it any thought. Your client may call you later and ask for some financial assistance, though, and it probably won’t be a pleasant conversation.

As with all IRS rules, I am sure that there are ways to draft an agreement to avoid the problem, and, of course, the amount of alimony can be adjusted up or down to accommodate the tax effects.

This IRS rule underlines the importance of including in your property settlement agreements a disclaimer that you have not provided any tax advice, and that the parties have been encouraged to get tax advice from a qualified expert.

November 11, 2010 § Leave a comment

The eyes of the world are upon you. The hopes and prayers of liberty-loving people everywhere march with you. — General Dwight D Eisenhower, address to his troops on D-Day, 1944

In war, there are no unwounded soldiers. — José Narosky

The only thing necessary for the triumph of evil is for good men to do nothing. — Edmund Burke

SOME THINGS YOU MAY NOT KNOW ABOUT GUARDIANSHIPS

November 10, 2010 § 2 Comments

Here are some things you may not already know about guardianships. Some of them have teeth that can draw blood if they catch you unawares …

- MCA § 93-13-38, provides that “All the provisions of the law on the subject of executors and administrators, relating to settlement or disposition of property limitations, notice to creditors, probate and registration of claims, proceedings to insolvency and distribution of assets of insolvent estates, shall, as far as applicable and not otherwise provided, be observed and enforced in all guardianships.”

- MCA § 93-13-33, requires that the guardian return an inventory within three months of the appointment, and states: “Any guardian who shall fail to return inventories may be removed and his bond be put in suit, unless he can show cause for the default.”

- When closing out a guardianship, the requirements of MCA § 93-13-77, must be satisfied. That section requires that a final accounting filed, and that the ward be summoned and given notice to be and appear before the court on a day not less than one month after the date that the summons is served or after completion of publication, to show cause why the accounting should not be approved. The accounting can not be approved earlier than one month after completion of process. All the requirements to close a guardianship are here.

- When a guardian has more than one ward, each ward’s business must be accounted for separately. MCA § 93-13-69.

- A child 14 or older has a statutory right to choose his or her guardian. If the ward is over 14, you should have the child join in the petition.

- Guardianship of a minor ceases by operation of law at age 21, and, in the discretion of the Chancellor, at age 18. The guardianship may also be terminated by order of the court at any time that the estate has a value less than $2,000 and no further funds or property are anticipated to come into the guardian’s hands. MCA § 93-13-75.

- Any claim for a guardian’s fee must include the information required in Uniform Chancery Court Rule 6.11.

- A “solicitor’s fee” (MCA § 93-13-79) may be allowed for the attorney, and the claim for it must be supported by an itemized statement of services rendered in the same form as that required for the guardian’s fee, plus the information required in Rule 6.12 of the Uniform Chancery Court Rules.