RECUSAL MERRY-GO-ROUND

January 17, 2013 § Leave a comment

I started to do a post to call your attention to the entertaining COA decision in the case of Boatwright v. Boatwright, but Lost Gap does such a good job expounding on it that I will simply defer and let you read about it there in a post titled, “MRCP 63 – Have you ever wondered what happens when a judge recuses after judgment but before ruling on post-trial motions?”

Enjoy.

FINALITY OF JUDGMENTS AND THE OPINION

January 16, 2013 § Leave a comment

Can a chancellor order alimony in an opinion to take effect before entry of the judgment?

That was the question in McCarrell v. McCarrell, 19 So.3d 168, 171 (Miss.App. 2009). In that divorce case, the chancellor had rendered a written opinion on December 20, 2007, concluding that Billy McCarrell should pay Janie McCarrell $1,800 a month in rehabilitative alimony, commencing January 5, 2008, and continuing for five years. The judgment corresponding to the court’s opinion was not filed and docketed by the clerk until January 18, 2008, thirteen days after the date of the first ordered payment. The judgment did incorporate the judge’s opinion.

Billy took the position that he was required only to comply with the final judgment, and not with the opinion. Since the final judgment was not entered until after the initial payment date was passed, he argued that the alimony obligation did not go into effect until after the date of the judgment.

On the face of it, Billy’s position makes some sense, because MRCP 58 states that “A judgment shall be effective only when entered as provided in MRCP 79(a),” and 79(a) defines entry as docketing on the General Docket showing the date of entry and a brief description, followed by filing in the court file.

What Billy overlooked, though, was the power of the chancellor to order interlocutory and temporary relief. The court said, beginning at ¶12:

… our jurisprudence recognizes that the chancellor possesses the statutory authority to order temporary alimony and make proper orders and judgments thereon. Miss.Code Ann. § 93-5-17(2) (Miss.2004). Moreover, courts are always deemed open for purposes of making and directing all interlocutory motions, orders, and rules. See also M.R.C.P. 77(a). * * *

¶ 14. Certainly, the chancellor possesses the authority to order temporary alimony and make all proper orders and judgments thereon. Miss.Code Ann. § 93-5-17(2); M.R.C.P. 77(a); see also Langdon v. Langdon, 854 So.2d 485, 496(¶ 44) (Miss.Ct.App.2003). The duty to pay temporary support terminates upon entry of the final judgment of divorce, but the judgment does not eliminate the obligation to pay temporary alimony arrearages which accrued before the entry of the final decree. Prescott v. Prescott, 736 So.2d 409, 416(¶ 35) (Miss.Ct.App.1999) (citing Lewis v. Lewis, 586 So.2d 740, 741 (Miss.1991)). Stated differently, a temporary order is not a final order; however, arrearages accrue on unpaid temporary support payments. Id. Further, temporary support orders are enforceable through contempt actions. [McCardle v.] McCardle, 862 So.2d at 1292(¶ 9); see also Bell on Mississippi Family Law § 9.01[5][c], at 236 (2005).

In this district, more often than not in more complicated cases I render a detailed opinion making findings of fact and conclusions of law, and I direct one of the attorneys to draft a judgment corresponding to the opinion, with instructions to present it to the court after it has been approved as to form by counsel opposite. Every now and then, a judgment will be delayed for one reason or another. McCarrell addresses what happens to the relief granted in that situation.

ATTORNEY’S FEES REVISITED

January 15, 2013 § Leave a comment

I sometimes quip that our body of case law is reaching biblical proportions, meaning that one can find authority to support opposite sides of most issues, and sometimes three or more sides.

Take the matter of attorney’s fees. It used to be fairly clear that in all but contempt you had to prove inability of the party to pay and the claim had to be proven reasonable via the McKee factors. In contempt actions proof of inability to pay is not relevant because the award is punitive.

Last September I posted here about the COA’s Bowen case, which reiterated the contempt rule, and remanded for proof of reasonableness under McKee. That post includes links to other posts on the subject of attorney’s fees.

In Brown v. Weatherspoon, decided by the COA on November 6, 2012, Kenyader Weatherspoon had produced DNA results proving conclusively that he was not the father of a child born to Serhonda Brown. Weatherspoon filed an MRCP 60(b) action seeking to set aside a prior judgment, to which he had agreed, establishing child support. Brown contested the 60(b) petition, and she persisted in a collection effort for unpaid child support. She also testified that she knew the identity of the natural father, and that she had no intention of suing him for child support. Based on Brown’s position, the chancellor assessed Brown $9,210 in attorney’s fees incurred by Weatherspoon in the case. Brown appealed.

In her appeal, Brown argued that she had the right to defend against the 60(b) action, and further that Weatherspoon would have incurred the fees anyway in the prosecution of his petition. She also argued that Weatherspoon failed to prove either inability to pay or the McKee factors.

Judge Roberts, writing for the COA, said:

¶22. The award of attorney’s fees is generally left to the discretion of the chancellor. Arthur v. Arthur, 691 So. 2d 997, 1004 (Miss. 1997) (citations omitted). “We are reluctant to disturb a chancellor’s discretionary determination whether or not to award attorney[’s] fees and of the amount of any award.” Id. (citation and internal quotation omitted). The chancellor based her decision to award Weatherspoon attorney’s fees on Brown’s vigorous insistence that Weatherspoon pay child support when, based on the DNA test results, Brown knew Weatherspoon was not M.B.’s father. The chancellor also noted that Brown knew the identity and whereabouts of the man she believes to be M.B.’s biological father, but she chose not to pursue paternity testing or child support from him. In her order, the chancellor referenced the fact that when Brown was asked why she had not sought child support from M.B.’s biological father, Brown responded that “she just did not want to.”

¶23. Furthermore, in McKee, the supreme court held that an award of attorney’s fees based on an estimated 850 hours worked on the case was too speculative to support the award. McKee, 418 So. 2d at 766-67. But when a chancellor bases an award of attorney’s fees on an itemized bill, there is substantial evidence to support the chancellor’s award. Dobbins v. Coleman, 930 So. 2d 1246, 1252 (¶27) (Miss. 2006). Weatherspoon submitted itemized bills from his attorney. The chancellor based her award on those itemized bills. Consequently, we do not find that the chancellor abused her discretion.

This was not an award of attorney’s fees based on contempt, so it is unclear why inability to pay was not a factor. The award was, however, in the nature of a sanction, since the chancellor was clearly punishing Sheronda for pursuing the futile action and thereby, I suppose, inflating both sides’ legal bills.

As for reasonableness, it would appear that either McKee proof or itemized bills will accomplish the same purpose. In other words, there must be something substantial in the record to support the chancellor’s finding that the fee award is reasonable. As I have said here before, my suggestion is that you put on proof of both the McKee factors and documentation of your time in the case, so that both are in the record if you need them.

THE QUIRKS OF RENUNCIATION

January 14, 2013 § 1 Comment

The COA case of Estate of Weill v. Weill, decided November 6, 2012, is a reminder of several quirks involved in renunciation of wills.

- MCA 91-5-27 provides that if the decedent made no provision for a surviving spouse, the survivor has a right to share in the estate of the decedent as in the case where there is an unsatisfactory provision (see below), and no formal act of renunciation is necessary. Tillman v. Williams, 403 SO.2d 880, 881 (Miss. 1981).

- In Weill, the decedent had left his surving spouse ” … my seven beloved dogs to care for. She is to be offered $25,000 from my assets to effect the transfer of my dogs to her home …” The chancellor and the COA rejected the appellant’s argument that the bequest was really for the benefit of the dogs, noting that the cash bequest was to her and not for benefit of the canines. Thus, since there was a bequest, she could not avail herself of MCA 91-5-27.

- MCA 91-5-25 provides that if the decedent ” … does not make satisfactory provision …” for the spouse (the statute uses the word “wife”), then the spouse may renounce the will by filing a formal notice to the effect of the language suggested in the statute, and the spouse will thereupon be entitled to share in the estate to the extent set out in the statute. The renunciation must be filed within 90 days of the date of the admission of the will to probate.

- In addressing one of the appellant’s arguments, the COA noted that a renunciation filed in the stautory form before probate of the will has been found to be adequate. Gettis v. McAllister, 411 So.2d 770 (Miss. 1982).

- In Weill, although the attorney for the widow had made it known to the court and counsel opposite that the widow intended to file a renunciation, no formal renunciation was filed within the 90 days. The chancellor and the COA rejected the claim that an oral statement of intent to renounce complied with the statute.

When it comes to probate matters, the bottom line is that the requirements are all statutory, which means that they must be strictly construed and followed. Do not expect a chancellor or appellate court to fudge requirements for you because you “came close.” The fact is that close gets you no cigar. You have to be right on target. What is required is right there in the law, in black and white. If you don’t read the law in advance, you have no one to blame but yourself when things go embarrassingly and expensively wrong.

PUTTING SLAVERY ON THE MAP

January 11, 2013 § 4 Comments

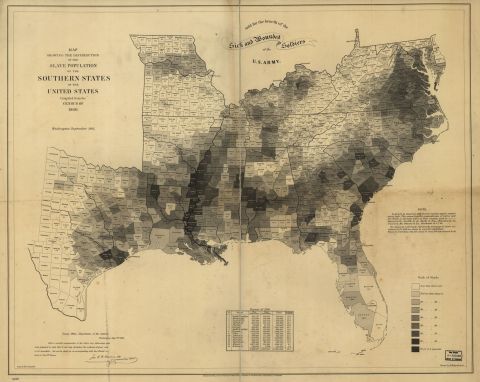

I ran across a most interesting map at the Library of Congress during the holidays. It depicts the percentage of slave population of the southern states, county by county, based on the 1860 census. You can click here or on the map to see it in zoomable form.

The picture below gives you an idea of the scope and distribution of slavery in the pre-civil-war south. The darker the color, the greater percentage of slave population in the county. Washington County in the Delta, for instance, had 92% slave population, while Jones County in the southeastern piney woods, had only 12%. Mississippi’s total population of nearly 800,000 was 55% slave, and only South Carolina, with 57%, had a greater percentage of slavery.

I hate to confess that I had no idea that slaves were as numerous as shown on the map. My ancestors in Vermilion Parish, LA, were poor, illiterate dirt farmers who could not afford slaves. Growing up we learned in school that the same was true of most folks in our area. Yet, when I look at the map, I am surprised that nearly a third of my Parish’s population at the time were slaves. It’s a sobering thought.

A GROWTH INDUSTRY FOR LAWYERS

January 10, 2013 § 3 Comments

Last weekend, as the mind-numbing parade of college bowl games played itself to an end, I noticed television ad after ad for legal do-it-yourself material. All of these spots proclaimed the ease and utility of their service, and painted a glowing picture of the marvelous legal landscape that even the most basic person could paint for himself.

One ad — I am not making this up — encouraged viewers to use their forms for “family trusts, incorporation and estate planning.” Those matters would be in addition to the more routine matters one might expect, like divorces, wills and custody. Oh, but what about anti-trust, shareholders’ derivative suits, patents and personal injury litigation?

I was sitting there pondering what these customers might do for tax advice as to the trusts, incorporation and estate planning, not to mention that as to all of the matters listed above — and many, many others — one size emphatically does not fit all, and there are all kinds of legal ramifications in the way documents are worded.

A few weeks ago I was presented with a provision in a computer-assisted property settlement agreement that read: “Husband shall pay one-half of the college expense of the minor children (transportation), and clothing and automobiles.” Ambiguous? You betcha. Not only is the husband’s obligation scarily unclear, particularly in light of Zweber, but what is wife’s obligation (my guess is none; that’s the most unambiguous part of the provision)? I denied the divorce and suggested they get the assistance of a lawyer.

But as I pondered these imponderables, it dawned on me that this legal self-help business may actually be a boon for the legal profession. Consider all of the litigation it will take to untangle all of those family trusts, corporations and estate plans. The tax lawyers, in particular, will have a field day.

Family law matters are another fertile field. Anyone who has practiced any length of time will tell you that representing parties later who represented themselves in a divorce is a pleasant undertaking because it is the client himself who got himself in this mess, and he will be the goat if you fail, while you be the hero if you succeed. That’s a win-win for the lawyer.

Okay, before anyone gets all offended, I confess that this post is most certainly tongue-in-cheek. None of us who understand the importance of the legal profession and the demands of professionalism takes any delight in the misfortune of those who venture without a competent guide into the legal jungle. It’s just hard to understand why any layperson would take the risk to save a few bucks.

COURTROOM CONFIDENTIAL

January 9, 2013 § Leave a comment

Parties to minor’s settlements sometimes come to court asking for the proceedings to be confidential and sealed. The requests in my court have ranged from asking that the courtroom be cleared and the transcript sealed to asking that the judgment alone be sealed. I have generally resisted on the basis that the public has a right to know what is transpiring in the courts. The procedure I follow is described below.

The MSSC on December 6, 2012, addressed the issue in the case of Ford Motor Co. v. Ferrell, et al. You can read the decision for yourself to get a grasp of the facts. The case involved a fee dispute arising out of a personal injury settlement. Ford requested that the terms of the settlement, which had been confidential by agreement, not be disclosed in the course of the fee-dispute proceedings.

Chancellor David Clark refused Ford Motor Company’s request to keep the settlement documents and trial proceedings sealed, based on his concern that court proceedings be transparent to the public. On appeal, Ford raised three issues: (1) Whether the settlement agreement is a public, judicial record or a private contract, which should be enforced; (2) Whether the state’s policy encouraging settlement agreements and the parties’ interest in abiding by the terms of that agreement are sufficient grounds to protect the settlement from public scrutiny; and (3) Whether there is any overriding public interest which would require disclosure of the terms of the settlement agreement.

A 5-4 majority of the supreme court, by Justice King, concluded that the terms of the agreement should be kept confidential — to an extent. Here’s what the court said, beginning in ¶32:

To continue to preserve the confidentiality of this agreement, the chancery court should seal the order approving the settlement agreement and should seal the settlement agreement itself (if it is admitted into evidence for any reason). The chancery court should also redact any mention of the settlement amount from future documents and prohibit the parties from mentioning the settlement amount in its proceedings. However, the chancery court may keep the fee-dispute trial’s transcript and proceedings open to the public, which addresses the chancellor’s concern regarding transparency in judicial proceedings.

* * *

¶33. The chancery court abused its discretion by denying Ford’s request to preserve the settlement agreement’s confidentiality. Although the public has a right of access to public records, Mississippi law also favors the settlement of litigants’ disputes and respects confidentiality agreements when practical. The law allows courts to determine when information should be declared confidential or privileged, exempting it from the Public Records Act. Because this settlement agreement is between private parties, does not involve matters of public concern, and is not necessary to resolve the fee-dispute claim, its confidentiality should be preserved. Thus, we reverse the chancellor’s denial of Ford’s motion to preserve the confidentiality of the settlement agreement. However, the fee-dispute trial’s transcript and proceedings should remain open to the public, so we affirm the chancellor’s denial of Ford’s motion to close the proceedings. The Court remands this case to the chancery court for further proceedings consistent with this opinion.

The procedure I have followed in minor’s settlements is to require proof of the terms of the agreement via an exhibit, which I will seal on request. That way, the terms of the settlement are of record and document what I considered in determining whether the settlement is in the best interest of the minor.

I have also steadfastly refused to seal or otherwise make confidential settlement agreements with public agencies, a position which appears to be consistent with the MSSC’s in this case.

The court’s decision distinguished its holding in Williamson v. Edmonds, 880 So.2d 313-314 (Miss. 2004), in which the court ruled that a confidential agreement must be disclosed in a fee dispute because, contrary to the situation in Ford, evidence of its terms was central to resolution of the claims involved.

SOME THINGS YOU NEED TO KNOW ABOUT CHILD DEPENDENCY EXEMPTIONS

January 8, 2013 § 4 Comments

Many property settlement agreements (PSA) involving children have a provision like this:

Husband shall claim the minor children as dependents for tax purposes in even-numbered years, and Wife shall claim the minor children as dependents for tax purposes in odd-numbered years.

What happens, though, where, despite the language of the agreement, the mom claims the children in an even-numbered year, and the father does, too? Is the language above enough to satisfy the IRS that the dad, and not the mom, was entitled to claim the exemption in that year?

The answer is no.

IRS regs require that if you are trying to base a claim for exemption on a writing that is not an IRS-designated form, the writing must conform to the substance of the IRS form and must be a document executed for the sole purpose of serving as a written declaration within the meaning of the IRS regs. A court order, PSA, handwritten note or any other document not meeting those requirements will not suffice. The claiming party must attach to the tax return a completed IRS form 8332 or a document including every element of it.

In the case of Armstrong v. Commissioner of Internal Revenue, decided December 19, 2012, by the US Tax Court (I do not have a cite for you) involved the scenario above. The court said:

The IRS’s Form 8332 provides an effective and uniform way for a custodial parent to make the declaration required in section 152(e)(2)(A) for the benefit of the noncustodial parent. But a noncustodial parent like Mr. Armstrong may also rely on an alternative document, provided that it “conform[s] to the substance” of Form 8332.5 See 26 C.F.R. sec. 1.152-4T(a), Q&A-3, Temporary Income Tax Regs., supra. In particular, for tax years including the year at issue here, a court order that has been signed by the custodial parent may satisfy section 152(e)(2)(A) as the noncustodial parent’s declaration if the document “conform[s] to the substance” of Form 8332.6 See Briscoe v. Commissioner, T.C. Memo. 2011-165 (concluding that the court order attached with the return did not conform with the substance of Form 8332); cf. Boltinghouse v. Commissioner, T.C. Memo. 2003-134 (holding a separation agreement conformed with the substance of Form 8332).

A basic element necessary for satisfying section 152(e)(2)(A) is a custodial parent’s declaration that she “will not claim” the child as a dependent for a taxable year. A custodial parent accomplishes this on a Form 8332 with the following statement: “I agree not to claim * * * for the tax year”. This statement is unconditional; and in order for a document to comply with the substance of Form 8332 and ultimately section 152(e)(2)(A), the declaration on the document must also be unconditional. See Gessic v. Commissioner, T.C. Memo. 2010-88; Thomas v. Commissioner, T.C. Memo. 2010-11; Boltinghouse v. Commissioner, T.C. Memo. 2003-134; Horn v. Commissioner, T.C. Memo. 2002-290.

The opinion points out that there are four considerations in determining whether a party is entitled to claim the dependency exemption: (1) Whether the “child receives over one-half of the child’s support during the calendar year from the child’s parents … who are divorced … under a decree of divorce”, sec. 152(e)(1)(A); (2) whether the child was “in the custody of one or both of the child’s parents for more than one-half of the calendar year”, sec. 152(e)(1)(B); or (3) whether “the custodial parent signs a written declaration (in such a manner and form as the Secretary may by regulations prescribe) that such custodial parent will not claim such child as a dependent for any taxable year beginning in such calendar year”, sec. 152(e)(2)(A); and (4) whether “the noncustodial parent attaches such written declaration to the noncustodial parent’s return” for the appropriate taxable year, sec. 152(e)(2)(B).

To rub a little salt in the wound, the Tax Court held that, since Mr. Armstrong had been ruled not to be entitled to claim the dependency exemption, the children were not “qualifying” within the regulations, so he could not claim the child credit, either. Ouch.

For drafting purposes, at a minimum you should include language that the non-claiming parent will timely execute IRS form 8332 for every tax year covered in the agreement. At least in that way you can ask the court for relief under MRCP 70(a). I have no idea whether a form executed by another party per the rule would satisfy the IRS, but it’s better than nothing. It would have the added benefit of documenting that you have made your client aware of the requirement of the form.

If I were practicing today, I would confer with my favorite CPA for advice about how best to avoid problems with this situation. Can you get the other party to sign ten years’ worth of forms in advance, each for the specific year in which your client will be claiming the exemption? I don’t know, but a CPA will know.

Of course, Mr. Armstrong could seek relief via contempt from the fomer Mrs. Armstrong. Contempt is a dish best served cold, as they say. But it has the disadvantages that one has to hire an attorney and try to collect money that may no longer be there. Yes, you can put that ex in jail, which may provide a measure of comfort and satisfaction, but it may not make you whole financially.

NOTE: Armstrong involves tax returns filed before the above-cited regs were adopted, and the language of the parties’ divorce decree included a clause that made claiming the exemption conditional upon payment of child support, but I believe my interpretation of the law above is accurate.

DRINKING FROM THE POISONED WELL

January 7, 2013 § Leave a comment

Copied this tip on one way to lose an appeal from a new blog, Lost Gap: Commentary of Mississippi Law:

Attack the trial judge. You might start out by suggesting that he must be on the take because he ruled against you. Or that he is senile or drunk with power, or just plain drunk. Chances are I’ll be seeing that district judge soon at one of those secret conferences where judges go off together to gossip about the lawyers. I find that you can always get a real chuckle out of the district judge by copying the page where he is described as “a disgrace to the robe he wears” or as “mean-spirited, vindictive, biased and lacking in judicial temperament” and sticking it under his nose right as he is sipping his hot soup. Trial judges love to laugh at themselves, and you can be sure that the next time you appear in his courtroom, the judge will find some way of thanking you for the moment of mirth you provided him.

Any trial judge can identify with that heavily tongue-in-cheek humor. We judges do get copies of your briefs and other filing with the appellate courts, and, while it may satisfy your primitive urge to take a retributive swipe in a brief at the one whom you feel wronged you, it’s best to keep in mind that judges are human, and can identify with Shylock’s plaint: “If you prick us, do we not bleed? If you tickle us, do we not laugh? If you poison us, do we not die? And if you wrong us, do we not revenge?”

That last statement is a tad much, I believe. Most judges practiced law long enough before taking the bench that they let most slings and arrows bounce off their thick hides. And most judges I know focus on the law and the facts of a given case, and try hard not to let the personalities of the lawyers or parties decide it.

Still, it’s hard to imagine why one would — to paraphrase a colorful, often-used lawyer adage — urinate in the well one has to drink from.

The rest of the post, copied from a law journal article by a Ninth Circuit appellate judge is an eye-opening exposition in outline form of the imaginative ways that lawyers poison their own cases on appeal. It’s something you should copy and put in that special place where you keep your practical practice guide material.

Check out Lost Gap for your legal reading. If it keeps up the way it started, it’s going to be worth looking at regularly. I’ve added a link over there on the right.

YEAR OF THE SNAKE

January 4, 2013 § Leave a comment

According to the Chinese zodiac — and who can argue with that — 2013 is the Year of the Snake.

The idea that this will be the Year of the Snake got me thinking about the law. I guess that’s because, after sharks, snakes are the most likely creatures to be mentioned in the same breath with lawyers, as in “A shark, a snake, and a lawyer walk into a bar …”

If you were born under the Sign of the Snake, the Chinese believe that you possess the snake’s attributes. So what can we learn about lawyers born under this serpentine sign? I did a little research to find out.

From what I read, the snake symbolizes such character traits as intelligence and gracefulness. Good start. Both are certainly desirable traits for any lawyer.

Snakes are also considered by the Chinese to be materialistic. Yes, this is what they maintain, but this seems problematic to me on a couple of counts. First, most materialistic people are considered “grasping,” but how can one grasp when one has no appendage with which to grasp? Second, I am unaware of any hoarding snake species, although I do have to confess that my lack of knowledge is due not only to lack of research on the subject, but also to utter reluctance to do any personal invesitigation. Too, it seems odd to me to think of snakes as materialistic. Magpies, yes. Raccoons, yes. Chimpanzees, yes. Copperheads, not so much. Lawyers? To be honest, I have to admit that the pursuit of materialism that is a motivator for many of us in the legal profession is more shark-like than snake-like.

Not mentioned anywhere in the sources I researched are the facts that snakes are cold-blooded, and have beady eyes, that forked-tongue thing, and fangs. All wincingly stereotypical lawyer traits. Snakes also eat fluffy, cute animals that would be great pets for little children if they were not eaten by the snakes. On the whole probably not so positive an attribute for lawyers, at least in most circles outside of the membership of the bar.

If you were born under this sign, you have no problem making an asp of yourself. Okay, I just made that up to be funny. If you thought it was funny, fangs a lot.

“When it comes to decision-making, Snakes are extremely analytical and as a result, they don’t jump into situations.” I read that on a web site. Now, I don’t know about you, but my encounters with snakes, both the deadly pit vipers, as well as the non-poisonous and merely scary-as-hell kinds, have never given me the impression that they are analytical. In fact, they impress me as being insanely impulsive. And if you’ve ever seen one strike up close, I think you would agree that they do, indeed, “jump into situations.” You would prefer that one not jump into your particular situation.

The authorities say that snakes are effective at getting the things they want. Yes, I think they usually do, considering the consequences of not giving a venomous reptile exactly whatever its cold-blooded heart desires.

According to one piece I read, snakes like calmness, preferring quiet over noise. This may be one reason why none of us has ever heard a snake scream.

Another source said that humans born under this sign want a manageable workload rather than a schedule that’s overly-booked, and they become easily stressed when their lives aren’t peaceful or in order. Next time you encounter a right choleric lawyer who turns out to be a snake, you just might find that she’s too busy and needs some orderly peace and quiet. I am sure you can contrive some ways to turn that to your advantage. But why would someone who craves peace, order and breathing room want to enter the high-pressure legal profession in the first place?

Good question, because although snakes are diligent, creative, hard workers who are excellent problem solvers, my research indicates that good career choices for snakes include: scientist, analyst, investigator, painter, potter, jeweler, astrologer, magician, dietician, and sociologist. No mention of the law.

In their personal relationships, snakes excel at seduction. Interesting. I always thought it was that turbaned flute player who had the cobra in thrall, but the Chinese say it’s vice versa. Snakes can be insecure (who knew?), jealous and possessive (grasping?). The snake is compatible with those born under the sign of the rooster and the ox, and incompatible with pig and monkey. There are all kinds of thoughts I could offer on that, but I will leave you to draw your own conclusions.

Finally, without going into too much detail, different snake years have the added attributes of metal, water, wood, fire, and earth. If you’re a snake, here are yours:

Metal Snake – Years 1941 and 2001

Incredibly goal-oriented, Metal Snakes will stop at nothing to get that which they believe they deserve. Failure is not in their vocabularies. With their money, they’re continually acquiring more and more possessions – for themselves.

Water Snake – Years 1953 and 2013

Influential, motivated, insightful, and highly intellectual are words that best characterize Water Snakes. These Snakes work well with others and enjoy being recognized and rewarded. They’ll reveal feelings to those closest to them, but no one else.

Wood Snake – Years 1905 and 1965

Kind and genuine, these Snakes enjoy building a solid foundation of friends and family whom they love deeply and whose company they enjoy immensely. But even with all this support, Wood Snakes rarely seek the advice of others.

Fire Snake – Years 1917 and 1977

Fire Snakes are more extroverted, forever offering opinions and telling others what’s on their minds. Even so, others enjoy listening to Fire Snakes. They’re very persuasive and are especially good at convincing others that their ways are best.

Earth Snakes – Years 1929 and 1989

Earth Snakes always seem to be calm and content. They’re friendly and approachable and believe that they’ll reap great rewards by working hard and relying on common sense.

I am proud to say that, as an ox myself, I am compatible with snakes. That’s for the best, since I have had many occasions to deal with, handle, and avoid getting bitten by any number of them through the years — professionally and otherwise. I’m with the snakes, too, when it comes to pigs and monkeys. The less I have to deal with those, the better.