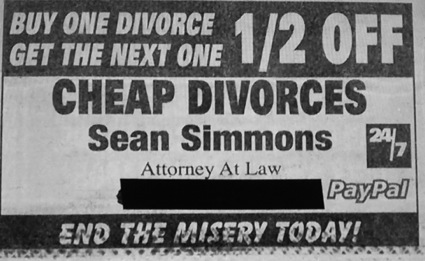

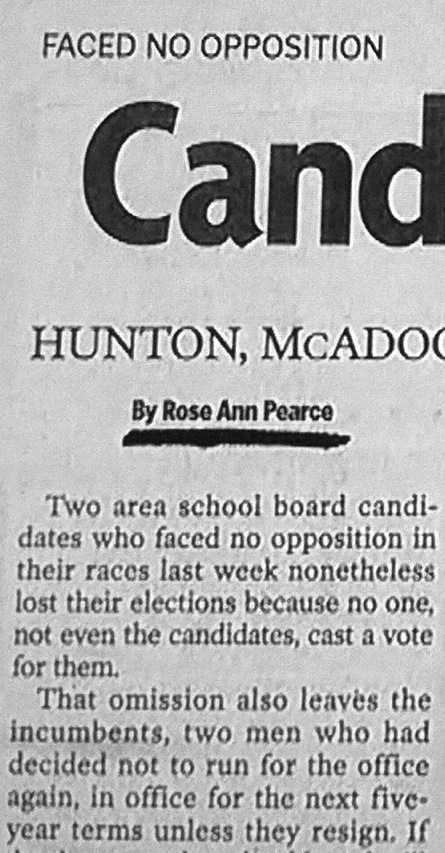

YET MORE SIGNS OF THE IMPENDING …

June 15, 2012 § Leave a comment

TOP TEN TIPS TO IMPRESS A CHANCELLOR AT TRIAL: #6

June 14, 2012 § 4 Comments

This is the fifth in a series counting down 10 common-sense practice tips to improve your chancery court trial performance. If you’re a long-time reader of this blog, some of these will be familiar. That’s okay. They bear repeating because they are inside tips on how to impress your chancellor, or at least how to present your case in a way that will help her or him decide in your favor.

TOP TEN TIP #6 …

Spend some time in trial prep making sure your 8.05’s will do their job.

Your UCCR 8.05 financial statement is often the most important document in evidence. If you have left it to the client to complete without any help, or it is slapped together, it won’t be as effective as one that has some thought and preparation behind it.

UCCR 8.05 states: “Unless excused by Order of the Court for good cause shown, each party in a domestic case involving economic issues and/or property division shall provide the opposite party or counsel, if known, the following disclosures …” And it goes on to spell out what the form needs to include.

Here are some ways to make your 8.05’s more effective:

1. Never present a financial statement that you have not gone over in detail with your client. You have seen hundreds, if not thousands, of 8.05’s, but this is probably the first one your client has ever seen. Why would you think that the client will somehow innately know how to complete it, and how to complete it effectively to aid his or her case?

As part of your trial preparation, question the client’s figures, test his or her mastery of the information on it. If your experience tells you that a figure is unreasonably high or low, question it and make the client defend it. If the client can not defend the number, suggest that the client reconsider it.

And while you’re at it, make sure that your client knows what he or she included in every category. Are there duplications? For instance, if your client charges clothing for the children on her MasterCard, did she duplicate the amount paid on the card in the line for clothing? Don’t just take your client’s figures at face value; inquire about them. I once asked a woman on the witness stand how she came up with $480 a month for entertainment, and she explained that was the amount she had spent the month before for flowers for her aunt’s funeral, and that her sisters were going to reimburse her. When I asked what she usually spent on entertainment, she said $50. In one fell swoop, I lopped $430 a month off of her expenses, diminishing her alimony claim against my client. Her attorney had simply taken her word for the $480 expenditure without questioning behind it.

If you really want to do an above-average job, require your client to have one or more bills in hand that support the figures claimed. For instance, two or three MasterCard bills showing expenditures for clothing and what has been spent on the card, and the tithe or donation report from the church, and the Comcast bills for the past 6 months, and the cancelled checks for utilities. That way when counsel opposite tries to attack a line item at trial, your client can confidently say, “Oh, yes, I can back that up.”

2. Always have the statement typed so that it clearly presents your client’s position. A handwritten statement with scratched-out figures and marks, notations and arithmetic that doesn’t add up will just add confusion and make the judge’s job unpleasantly more difficult. Take the time to type the figures in their proper places and make sure they add up properly. Remember: the easier you make the judge’s job, the more likely it is that you will have a happy outcome.

3. Make sure the tax returns are attached. Copies of the preceding year’s state and federal income tax returns ”in full form as filed” are required. This means that all schedules and w-2’s must be attached. If a document was sent with the original return to the IRS, a copy of it must be included.

4. Have an adequate number of copies. “When offered in a trial or a conference, the party offering the disclosure statement shall provide a copy of the disclosure statement to the Court, the witness and opposing counsel.” This means that, in addition to the original in evidence, you should have three additional copies, plus one for yourself. It does your client absolutely no good for the court not to have a copy to look at while your client is being examined about it. It would even be a good idea to provide an extra copy for the judge to mark up with his or her own notes during testimony.

5. Include a complete employment history. Some lawyers have deleted this from the form in their computers, for some reason, but it is specifically required in the rule: “A general statement of the providing party describing employment history and earnings from the inception of the marriage or from the date of the divorce, whichever is applicable.” This information is vitally important in connection with property division, alimony, child support and even child custody, and yet it is often omitted by lawyers.

6. Be sure to address any discrepancies in your examination of the witness. If your client has a perfectly logical explanation why the cell phone bill is $375 a month, be sure to cover it. If expenses exceed income, how is the client managing to pay the difference? If your client’s year-to-date income includes a one-time bonus that will never be repeated, notate that and have your client testify about it; if you don’t explain it, you can expect that the judge will include the bonus in your client’s income.

7. Use an up-to-date statement. A financial statement prepared six months ago in discovery and not updated since is simply not a statement of ”actual income and expenses and assets and liabilities,” as required in the rule. It defeats the purpose of the rule for a witness to spend a couple of hours explaining how the statement should be updated when that should have been done in trial preparation. If you come to court without an updated statement, the court may continue your trial to require you to prepare one.

8. Have your client sign and date the statement. The Court of Appeals has been critical of unsigned financial statements.

9. It’s better to hit the highlights than to needlessly repeat every item. The best way to lose your judge’s attention completely is to go over every line with your client. Better to touch on the items that are most important to your client or most susceptible to attack on cross.

10. Remember that a month has more than four weeks. A month is 52 weeks divided by 12, or 4.3. A client who says “I get paid $400 every Friday, so I make $1,600 a month” is wrong; the correct amount would be $1,720.

11. Number the pages. It saves the fumbling around as the witness and the court are trying to orient themselves to your questioning. And use the page numbers in questioning the witness: “Ms. Smith, look with me at page 3, line 6.” That’s a lot clearer and easier for a witness to follow than asking “Now you say you spend $200 a month on clothes for yourself; how did you come up with that?”

12. Add or delete categories to meet your needs. Your client spends $65 a month buying yarn and other materials to feed her knitting habit. Why not replace an unused category like “Transportation (other than automobile)” with “Hobby Expenses.” It would be a whole lot clearer than lumping it in with household expenses or something else, and will make it easier for your nervous client to understand while testifying.

13. Don’t list a deduction as “mandatory” when it is not. Deductions required by law, such as taxes and social security are excluded from adjusted gross income for calculation of child support. Voluntary contributions, such as 401(k) deductions, health insurance premiums, and the like are not excluded from income. When you list voluntary deductions as “mandatory,” you are at worst planting false information in the record, and at best confusing the record. Your client does not know the distinction. This is part of practicing law: advising your client how to properly fill out his or her 8.05.

14. Attach a current pay stub. Pay stubs are a marvelous source of information. Quite often clients (and attorneys, I am sad to report) miscalculate income. A current pay stub, preferably with year-to-date (YTD) info is a great tool to check the income figures. Pay stubs also show the true amounts of overtime, bonuses, deductions for insurance and other items, and retirement contributions.

15. Tailor your 8.05 to the case you are trying. In a divorce case, you can have one column of figures showing your client’s current expenses, one showing the household expenses before the separation (to show standard of living), and a third column showing her anticipated expenses following the divorce. In a modification case, add a column on both the income and expense side showing what your client’s income and expenses were at the time of the judgment you are seeking to modify.

You should redact all Social Security numbers. The proper procedure to accomplish this is in UCCR 8.05(B).

Keep in mind the cardinal rule of practice in chancery court: “The easier you make the chancellor’s job, the more likely you will have a favorable result.” When you present an 8.05 that is hastily scribbled out by a client with no guidance, with uncalculated or undecipherable figures, without the proper documentation attached, in sloppy form, you are making the chancellor’s job disagreeably more difficult, and you may not enjoy the outcome.

UNMARRIED RELATIONSHIPS IN MISSISSIPPI

June 13, 2012 § 10 Comments

Mona Cates and Elizabeth Swain were involved in an intimate relationship with one another that spanned five years in three different states. They both contributed to the accumulation of equity in real property and financial assets while they were together. Swain did not want her name on the title to a home the parties purchased because she was still married to a man in another state, and did not want to give him any claim to her interest. In time, the relationship between Cates and Swain soured. Swain moved out of the DeSoto County home titled in Cates’s name and sued Cates, alleging that Cates had been unjustly enriched by the living arrangement. She sought equitable relief. Swain’s position was that she and Cates were parnters in several joint ventures. Cates took the position that to grant Swain’s prayer for relief would violate Mississippi’s ban on same-gender marriage.

The chancellor disagreed with Swain and overruled her motion to dismiss on the basis that the issues before him involved constructive trust or resulting trust and unjust enrichment, and that the issue of same-gender marriage was not necessary to that analysis. Following a trial, the judge found that Swain had been unjustly enriched and awarded Cates a judgment for $44, 495, and rejected the claim of any impled trust. Cates appealed from imposition of the judgment, and Swain cross-appealed from rejection of the trust-based claims.

In Cates v. Swain, decided April 17, 2012, the COA reversed the judge’s ruling on unjust enrichment. The opinion, by Judge Maxwell, notes that the chancellor found that no contractual relationship between the parties existed, and there was no evidence that the parties entered a business enterprise for profit. It goes on to point out that much of the trial record reads like a divorce trial, although any marital relationship or marital-type relief would have been barred by § 236A of the Mississippi Constitution, ratified November 2, 2004. The opinion states that “With no contractual or marriage-based remedies available to her, Swain bases her claim on the equitable principles of implied trusts and unjust enrichment.” The opinion continues:

¶20. Mississippi does not enforce contracts implied from the relationship of unmarried cohabitants. In Davis v. Davis, 643 So. 2d 931, 934-35 (Miss. 1994), the Mississippi Supreme Court addressed a claim by unmarried cohabitant, Elvis Davis, that she was entitled to equitable distribution of property her boyfriend had acquired while they lived together. Relying on Estate of Alexander, 445 So. 2d 836, 840 (Miss. 1984), the supreme court acknowledged any rights of a cohabitant would have to be provided by the Legislature—and the Legislature had clearly abolished common law marriage rights in 1956. Davis, 643 So.2d at 934-35 (citing Miss. Code Ann. § 93-1-15(1) (1972)). In denying Elvis Davis equitable distribution, the supreme court reiterated its earlier position in Estate of Alexander:

We are of the opinion that public policy questions of such magnitude are best left to the legislative process, which is better equipped to resolve the questions which inevitably will arise as unmarried cohabitation becomes an established feature of our society. While the judicial branch is not without power to fashion remedies in this area, we are unwilling to extend equitable principles to the extent plaintiff would have us to do, since recovery based on principles of contracts implied in law essentially would resurrect the old common-law marriage doctrine which was specifically abolished by the Legislature. Davis, 643 So. 2d at 934-35 (quoting Estate of Alexander, 445 So. 2d at 839) (emphasis added).

¶21. Prior to the supreme court’s 1984 decision in Estate of Alexander, Mississippi had not addressed the equitable rights of unmarried cohabitants, though the Court had previously considered the equitable rights of “putative wives”—women who had ceremonially married but did not, in fact, have a legally valid marriage. See Chrismond v. Chrismond, 211 Miss. 746, 52 So. 2d 624 (1951) and Taylor v. Taylor, 317 So. 2d 422 (Miss. 1975). In Estate of Alexander, the supreme [court] acknowledged the “putative spouse” line of cases but found them “factually quite dissimilar and thus not controlling” where there “was not even any attempted legal ceremonial marriage but a mere ‘live-in’ relationship[.]” Estate of Alexander, 445 So. 2d at 839. Our supreme court evaluated a variety of approaches from other states * * * Ultimately, Mississippi opted for what it deemed “the logical view . . . [as] stated by a Michigan court”—that public policy questions of this stature should be left to the legislative process, and the judicial branch should avoid fashioning implied contractual remedies that would essentially resurrect common-law marriage, which had been abolished by the Legislature. [Citations omitted]

¶22. Based on the principle established in Estate of Alexander and Davis, we find public policy questions concerning same-sex cohabitants’ rights, just as with opposite-sex cohabitants rights, “are best left to the legislative process.” Davis, 643 So. 2d at 934. We note the Mississippi Legislature in 1997 declared no marriage rights exist in Mississippi Laws between same-sex partners, even those with valid marriages in other jurisdictions. Miss. Code Ann. § 93-1-1(2). And in 2004, House Concurrent Resolution 56 proposed to amend Mississippi’s constitution by creating a new section on marriage. On November 2, 2004, Mississippi voters ratified Section 236A. Under this constitutional amendment:

Marriage may take place and may be valid under the laws of this state only between a man and a woman. A marriage in another state or foreign jurisdiction between persons of the same gender, regardless of when the marriage took place, may not be recognized in this state and is void and unenforceable under the laws of this state.

Miss. Const. art. 14, § 263A.

¶23. Because the issue of same-sex marriage has been addressed by the legislative process, we find we must yield to the supreme court’s admonition against judicially creating equitable remedies that undermine these policy decisions—particularly when this policy has been written into Mississippi’s constitution. Thus, we hold we cannot extend implied contractual remedies to unmarried cohabitants, whether opposite-sex or same sex—especially here, where the chancellor found no express agreement beyond mere cohabitation that would support Swain’s claim that she be repaid for financial contributions she made during their relationship. Furthermore, Swain was married to another man and could not validly marry Cates even in a jurisdiction that recognizes same-sex marriage. Therefore, the limited putative spouse doctrine is inapplicable.

¶24. While chancellors typically enjoy discretion in determining equitable remedies in nondomestic matters, the supreme court has held it is outside the chancellor’s discretion to fashion an equitable remedy for an unmarried cohabitant “based on principles of contracts implied in law.” Estate of Alexander, 445 So. 2d at 839. But see Estate of Reaves, 744 So.2d at 802 (¶11) (finding Mississippi’s public policy against same-sex marriage does not prohibit same-sex partners from entering valid express contracts with each other).

¶25. “Unjust enrichment” is “modern designation for the doctrine of ‘quasi-contracts[.]’” Koval v. Koval, 576 So. 2d 134, 137 (Miss. 1991) (quoting Magnolia Fed. Savings & Loan v. Randal Craft Realty, 342 So. 2d 1308, 1311 (Miss. 1977)). “[T]he basis for an action for ‘unjust enrichment’ lies in a promise, which is implied in law, that one will pay to the person entitled thereto which in equity and good conscience is his.” Id. “It is an obligation created by law in the absence of any agreement; therefore, it is an implied in law contract.” 1704 21st Ave., Ltd. v. City of Gulfport, 988 So. 2d 412, 416 (¶10) (Miss. Ct. App. 2008) (citing Koval v. Koval, 576 So. 2d 134, 137 (Miss. 1991)) (emphasis added).

¶26. By holding Cates was unjustly enriched through her cohabitation with Swain, the chancellor essentially found an implied contract that Swain would be remunerated for her financial contributions to Cates. Estate of Alexander and Davis restrict such an implied contract arising between unmarried cohabitants. Swain testified to the financial benefits and obligations arising out of her marriage to her estranged husband. Thus, it was reasonable for her to understand similar rights did not arise from her relationship with Cates. As in Estate of Alexander, Swain’s financial contributions to the homes in which she cohabited, rent free, with Cates must be viewed as given gratuitously without expectation of repayment, absent evidence of an express agreement between the two. See Estate of Alexander, 445 So. 2d at 840. In the instructive words of supreme court in Estate of Alexander, “[a] deed or contract would also have sufficed.” Id.; see Estate of Reaves, 744 So. 2d at 802 (¶11). [Footnotes omitted]

¶27. The chancellor made no finding of any express agreement, but instead found Swain’s expectation of repayment was implied based on the women’s cohabitation arrangements. The supreme court has been explicit that cohabitation alone cannot form the basis of an equitable remedy between non-married cohabitants. Because we find the chancellor’s unjust enrichment remedy was outside the bounds of a chancery court’s equitable powers regarding such cohabitants, we must reverse the award of $44,995 and render judgment in Cates’s favor.

That’s a lengthy quote from the decision, but it merits your attention. Same-gender and unmarried cohabitation arrangements are becoming more and more common, and you need to know exactly how to advise your clients about how to protect themselves.

The state of the law would appear to be that neither unjust enrichment nor equitable remedies in the nature of implied trusts will be available to protect your clients in such situations, no matter how long the relationship continued or what was the level of investment, absent fraud, incapacity or undue influence. The courts will recognize bona fide partnership contracts, but those will require consideration and all of the formalities. Judge Russell’s separately concurring opinion points this out and finds it to be an inequitable result, although she agrees that it is within the exclusive province of the legislature.

Judge Lee’s dissent is also worth your time to read. He would uphold the authority of the chancellor to grant equitable relief in these cases. The majority, however, would leave any change in the status quo to the legislature.

The bottom line is that no matter how long the relationship, or the gender of the parties, or the nature of the relationship, or the nature of the investment, or the amount of the investment, or the mutual promises made, or the changes in position based on those mutual promises, there will be no relief absent fraud, etc. or contract, until the legislature acts.

A TICKLISH SUBJECT

June 12, 2012 § 2 Comments

How do you keep track of the deadlines and scheduled matters that are ticking away among your client files?

Most grizzled veterans know that the answer lies in a reliable “tickler” systam — some call it a “diary” system — that will call your attention to those matters.

When I practiced, the secretaries would create a card for every case file. I would examine the file and note a date on the front cover, like “7-12-12,” and return it to the secretary. She would then note the date on the file card and deposit the card in an index-card box that contained monthly tabs with numbered sub-tabs 1-31 between them. That file card would go in the July 2012 tab, between the 7-11-12 cards and the 7-13-12 cards. The file itself was then filed in its proper, alphabetical place. Each morning, the secretary would extract the cards for that day, pull the corresponding files and place them on my desk. I would then examine the files and do the work that needed to be done to keep those files current, like prepare pleadings, write letters, schedule an event, or respond to discovery. Before I returned the file to the secretary I would notate it with a later tickler date, and the secretary would process it back into the file system as described above. Sometimes a tickler date was only to make me look at the file to check its status. In any event, no file went into the system without a current tickler date unless it was finally closed. Once a month the secratary was responsible to go through the tickler cards to ensure that no card was misfiled, or that a card had been overlooked. This was the system for handling files only. There were two separate, redundant calendaring systems for court appearances, appointments, and important deadlines.

That’s a rudimentary tickler and calendaring system, and I am sure that many attorneys out there have more elaborate or more effective systems or ways of doing things.

Not all lawyers are effective at organization. New lawyers are understandably helter-skelter as they discover the intricate pitfalls of practice that await the naive. Even veterans, however, who become complacent and careless, can fall into a snare.

The point is, if you are a young lawyer starting out, you have got to get yourself organized so that you do not miss deadlines and court appointments, or fail to do it at your peril. It’s not so hard when you first open your law office and have only three files leading to litigation among a dozen or so other miscellaneous matters that don’t require scheduling. As your practice grows, however, you have got to systematize or face the wrath of a judge or a client.

And if you are a more experienced lawyer who finds yourself chronically late or a no-show, or who misses deadlines, or who can’t keep track of your probate practice, you’d better come up with a way to do it. Or else.

There are law practice managament software programs available that can do the task for you in a more streamlined way than the 19th-century system described above. Here’s a link to an article that describes some of them.

When it comes to managing your time, workload and deadlines, don’t just sit there; do something. The success or failure of your career depends on it.

MRCP 54(b): GRAVEYARD OF APPEALS

June 11, 2012 § 3 Comments

2011-2012 is shaping up to be the MRCP 54(b) graveyard of appeals. Two more recent COA decisions have deep-sixed appeals where the appellants had taken the case up from a less-than-final judgment, adding to the growing list of dismissed appeals.

In Rebuild America v. Countrywide Home Loans and Bank of NY, decided May 15, 2012, Chancellor Carter Bise granted Countrywide’s and BNY’s motion for summary judgment, which set aside two tax sales to Rebuild America. Countrywide and BNY filed a pleading seeking confirmation of title and dismissal of all other defendants, but before it could be heard Rebuild America filed its appeal. The motion for a judgment was filed September 10, 2010, and has been held in abeyance these past 20 months pending the outcome of the appeal.

To make a long story short, Judge Griffis’s majority opinion once again points out what a lengthening line of cases has painfully established: if the judgment disposes of fewer than all of the issues or fewer than all of the parties, then it is not a final, appealable judgment unless the judge has properly certified it under MRCP 54(b). The appeal must be dismissed for lack of jurisdiction, and that is exactly what happened here … appeal dismissed.

So here, after a twenty-month delay and who-knows-how-much in fees, expenses and costs for the appeal, these folks are right back where they were on September 10, 2010.

In McMullin v. McMullin, decided May 29, 2012, Chancellor Dan Fairly had awarded custody clearly contingent on obtaining further evidence from a physician, and the record was kept open for that purpose. The appellant appealed anyway, with predictable results. The COA on its own motion restated the obvious point that you can not appeal from a less-than-final judgment unless and until the trial judge has certified the case under MRCP 54(b), and that certificate must make findings that comply with the rule. In neither McMullin nor Rebuild America did the appealing party seek or obtain MRCP 54(b) certification from the judge before filing the appeal.

Even with a 54(b) certificate, your appeal may fail if the appellate court finds that judge’s reasons inadequate or missing, or if the appellate court finds that the chancellor abused her discretion in granting it.

More posts on MRCP 54(b) are here, here, here, here, here and here. Ironically, one of those posts is entitled, “Finally, the Final Word on Finality.” At the rate we’re going, though, I suspect that there will be a few more “final words” on this subject before the year is out.

DICTA

June 8, 2012 § 4 Comments

- America’s worst colleges.

- Recipe for disaster = Law degree + $150,000 in debt + no job.

- Just a bit of info: there are 10,729 members of the Mississippi Bar, of whom 8,764 are in active practice. There are 1,965 inactive members. On average that’s 106.87 lawyers per county, and one lawyer for every 339.9 people in the state. Of course, lawyers are not evenly distributed among all of the counties (e.g., there are only 5 active attorneys in Clarke County), and the numbers do include members of the Mississippi Bar practicing in other states.

- Should victims in the Sandusky molestation trial be required to disclose their full names on the record? The judge ruled that they must in the Pennsylvania trial.

- Two things I learned growing up: it’s impolite to wear a hat indoors, and never chew gum in church or in a formal setting like a court room. My, how things change over the years. And don’t get me started about driving in the left lane on a 4-lane highway.

- The entire text of Fred Rodell’s then-scathing 1939 assessment of the legal profession, Woe Unto You, Lawyers! is available for you to read or download. It’s quaint in some ways, but scary-true in others.

- Jed Perl reflects on Picasso’s Struggle to Reconcile Feeling and Form, with some thoughts about how the artist whom many revere as the iconoclast of realism might have viewed the work of that supreme realist, Rembrandt.

TOP TEN TIPS TO IMPRESS A CHANCELLOR AT TRIAL: #7

June 7, 2012 § Leave a comment

This is the fourth in a series counting down 10 common-sense practice tips to improve your chancery court trial performance. If you’re a long-time reader of this blog, some of these will be familiar. That’s okay. They bear repeating because they are inside tips on how to impress your chancellor, or at least how to present your case in a way that will help her or him decide in your favor.

TOP TEN TIP #7 …

Put on proof of jurisdiction.

Your pleadings are not proof. It’s your job to establish jurisdiction. Yes, it’s your job, not the judge’s. Yet, I have had to do it on more than one occasion for the attorney. Why would I do that? because it beats the heck out of having to retry the case on remand for lack of jurisdiction the first go-round.

Jurisdiction is vital. Without it the court can not proceed. So …

- If you are trying a divorce, you have to ask your witness about residence in the state of Mississippi for the requisite time, and you have to establish venue (which is jurisdictional in a divorce), and, of course, that there was a marriage in the first place a marriage.

- If you are trying a modification, you have to establish that the court has continuing jurisdiction by virtue of a prior judgment; and ditto for a contempt action.

- If you are trying a contempt, you have to introduce the judgment of which you claim the defendant is in contempt.

- If you are trying a statutorily-created action, such as grandparent visitation or partition, what are the facts that confer jurisdiction on this particular court?

- If you are trying a property dispute, where on this green earth is the property located?

The pleadings are not evidence in chancery court. Don’t think just because it’s in the pleadings that it is proven. The pleadings are your template for what must be proven through competent evidence at trial. If you want the trial judge and possibly the appellate court to consider it, you must put it into the record at trial.

I suggest you always put on proof of venue because some statutes, like the divorce statutes, confer jurisdiction through venue. In other words, if a statute designates venue, and you file in the wrong venue, the court has no jurisdiction and you will be wasting time, effort and the judge’s patience.

PRICE HIKE

June 6, 2012 § 3 Comments

You’re receipting clients now, I know, for some things you plan to file in July, so don’t forget that MCA 25-7-9 is amended, effective July 1, 2012, to add $40 to court costs in chancery court.

That fault-based divorce or other itigation that costs $99 now to file will cost your client $139 starting July 1.

Irreconcilable differences divorces and other matters that have been $54 will increase to $94.

HB 1268 MERITS YOUR ATTENTION

June 5, 2012 § Leave a comment

Back in 2007, the legislature made some sweeping changes in the adoption statute, particularly with regard to jurisdiction and venue.

The 2012 legislature has made some more changes, embodied in HB 1268, which take effect July 1, 2012. That means that if you have an adoption pending on that date, you’d better be prepared to meet its requirements. I suggest you click on the link and print yourself a copy so you can change your office forms and procedures.

Here is a summary of the changes:

- The child (the term I will use for the person — adult or child — who is to be adopted) may not be placed in the home of or adopted by the adoptive parent(s) before a court-ordered or voluntary home study has been completed. MCA 93-17-3(6). (See comments below)

- The required home study must be done by a licensed adoption agency, or a licensed, experienced social worker approved by the chancery court, or by the DHS “if required by MCA 93-17-11” (See comments below). MCA 93-17-3(6).

- For out-of-state adopting parents, the Interstate Compact for Placement of Children (MCA 43-18-1, et seq.) must first be complied with. Evidence of placement approval (forms 100A and 100B) must be placed in the permanent adoption record file. Also, a minimum of two post-placement reports conducted by a licensed placement agency must be filed with DHS Interstate Compact for Placement of Children Office. MCA 93-17-3(7), a newly added provision.

- The Indian Child Welfare Act (ICWA) must be complied with, if applicable. If the ICWA is not applicable, the petition must state that it is not applicable, or an affidavit to that effect must be on file before finalization. MCA 93-17-3(8), a newly added provision.

- The post-adoption reports required in MCA 93-17-205 are changed. These are forms that are required to be filed with the State Department of Health, Bureau of Vital Records. MCA 93-17-205.

Comments: It is not at all clear to me how the new language in MCA 93-17-3 regarding home studies will interface with MCA 93-17-11. The language of section -3(6) starts out in seemingly mandatory fashion, but ends with “if required by Section 93-17-11” language. MCA 93-17-11 is the code section that allows the chancellor in his or her discretion to require a home study. My best guess is that the new language in -3(6) will be interpreted to define who has authority to do the home study that may be ordered by the court in -11.

Notice the ICWA pleading requirement. You’d best add it to your forms.

RFA’S, SANCTIONS AND THE “GOTCHA” EFFECT

June 4, 2012 § Leave a comment

Let’s say you are in the discovery stages of a child support modification case. Along with all of the other, usual discovery you send counsel opposite an MRCP 37 request for admission (RFA) to admit that the attached document is a “true, correct and authentic” copy of the minor child’s medical bills for the period 2008-2012. The bills would document in part the child’s increased expenses over the two years following the divorce. Because you are seeking authentication, you attach only the bills themselves, and not any self-authenticating certificate.

A couple of weeks later, you receive the response: “Denied. Respondent is without sufficient information to determine whether Exhibit A is a true, correct and authentic copy of the document which it purports to be.”

Since opposing counsel would not admit authenticity, you do the heavy lifting to get the documents authenticated at trial, and — a little p.o.’d at the extra work — you then ask the chancellor to impose sanctions, per MRCP 37(c), which states that the judge “shall” impose sanctions for failure to admit, unless the court finds certain factors present. Much to your chagrin, the trial judge overrules your motion, saying ” … the MRE provide procedures for authenticating medical records and entering them into evidence that do not involve the party opposite admitting to them. Further, the court recognizes that [your opposing party] did not prepare the records and is not the custodian.”

The scenario above is what happened in the case of Rhoda v. Weathers, decided by the MSSC on March 8, 2012, which reversed in part the COA’s previous ruling in the case. The MSSC decision is not designated for publication in the permanent reports, and is subject to being withdrawn, so you may not cite it as authority (rehearing was denied May 24, 2012). Chief Justice Waller’s opinion, though, has a thoughtful discussion of the real purpose for and approach of Rule 37 and the provision for sanctions. Here are some excerpts that explain the court’s reasoning:

¶6. A trial court’s decision whether or not to impose sanctions for alleged discovery violations is reviewed for abuse of discretion. Jones v. Jones, 995 So. 2d 706, 711 (Miss. 2008). The trial court’s decision should be affirmed unless a reviewing court has a “definite and firm conviction that the court below committed a clear error of judgment in the conclusion it reached upon weighing of relevant factors.” Id. (quoting Cooper v. State Farms Fire & Cas. Co., 568 So. 2d 687, 692 (Miss. 1990)).

¶7. When a party fails to admit a matter or the genuineness of a document that is later proven at trial, the requesting party may move the court to require the other party to pay the reasonable expenses the requesting party incurred in proving the matter or document. M.R.C.P. 37(c). The Rule states that the court “shall” make the order, unless it finds: 1) that the request was objectionable under Rule 36(a); 2) that the admission sought was of no substantial importance; 3) that the party failing to admit had reasonable ground to believe he might prevail on the matter; or 4) that there was other good reason for the failure to admit. M.R.C.P. 37(c).

¶8. The Court of Appeals held that none of the exceptions listed above applied to the requests. Rhoda, 2011 WL 3452121, at *6. The Court characterized Rhoda’s request as requesting that Weathers “admit the genuineness and admissibility of [Rhoda’s] medical records.” Id. However, the Court’s opinion did not specifically address what comprised these “medical records.” In fact, Rhoda requested that Weathers admit to the genuineness and admissibility of medical bills and various prescription receipts. However, the authenticity of these documents and their admissibility into evidence at a civil trial were matters outside of Weathers’s knowledge, thereby making her denials of the requests appropriate and not subject to sanction.

¶9. The purpose of requests for admission under Rule 36 is “to determine which facts are not in dispute.” DeBlanc v. Stancil, 814 So. 2d 796, 802 (Miss. 2002). “It is not intended to be used as a vehicle to escape adjudication of the facts by means of artifice or happenstance.” Id. ¶10. Mississippi Rule of Evidence 803(6) provides that business records may be admitted at trial. However, for the records to be admissible, the rule requires that the custodian or “other qualified witness” testify to their authenticity. M.R.E. 803(6). Otherwise, the document must be self-authenticating pursuant to Rule 902(11). M.R.E. 803(6). For a document to be self-authenticating, it must include a “written declaration under oath or attestation” from a custodian or other qualified witness that meets the authentication requirements of Rule 803(6). M.R.E. 902(11). [Emphasis in bold added]

¶11. Had Rhoda attached proper attestation of the documents’ authenticity when he propounded his requests, then Weathers would have had no good reason to deny the documents’ genuineness and authenticity. However, in his request, Rhoda failed to attach to his medical bills any affidavits or other written declarations by the custodians of these bills, or any other qualified witnesses, attesting to their authenticity. In essence, Rhoda’s requests sought to contravene the Mississippi Rules of Evidence. Rather than properly authenticating his medical bills according to the Rules of Evidence, he attempted to authenticate them by “artifice or happenstance.” As Weathers was neither the custodian of the documents nor a qualified witness, she did not have the requisite information to determine whether the bills were true, correct, and authentic copies of what they purported to be, nor did she have knowledge of how the bills were prepared. Weathers stated as much in her responses to the requests for admission. As such, she had “good reason” for failing to admit to Rhoda’s request. See M.R.C.P. 37(c); 8 Wright & Miller, Federal Practice and Procedure § 2290, 629 n.15 (“Since a statement of reasons why the party is unable truthfully to admit or deny is expressly permitted as a response to a request . . . it would be quite anomalous if a party who has stated valid reasons why this is so should be required to pay his opponent’s expenses.”). Recognizing this, the trial court refused to sanction Weathers for failing to admit to Rhoda’s requests. Under these facts, it cannot be said that the trial court abused its discretion in denying Rhoda’s motion for expenses. See Estate of Bolden ex rel. Bolden v. Williams, 17 So. 3d 1069, 1072 (Miss. 2009) (“A trial court has considerable discretion regarding discovery matters.”).

Some lawyers like to play “gotcha” games in litigation, and MRCP 37’s strict 30-day deadline and punitive provision for sanctions are tailor-made for that approach. Rhoda makes clear, however, that the courts prefer to hew to the true purpose of the rule, which is to help winnow out the facts that are not in dispute, and they reject attempts to escape adjudication of the facts by means of artifice or happenstance.

The Cooper case, cited in Rhoda, above, includes a discussion of the sanctionability of RFA’s addressed to the ultimate issue. In that case, the ultimate issue was whether the fire loss was due to arson. The court said at p. 689:

The larger point being that RFA’s aimed at the ultimate issue are going to be deemed by the court to be ineffective, and you need to be prepared to make your case.

[Thanks to COA Judge Ken Griffis for bringing the Rhoda case to my attention]