THE FAMILY USE DOCTRINE IS ALIVE AND WELL

January 18, 2011 § 3 Comments

It is well settled in our jurisprudence that a gift to or inheritance by one of the parties during the marriage is separate property unless it loses its separate character through some act of the parties. Title, for instance, may be changed from individual to joint. Or separate funds may be commingled to the extent that they lose their separate character. Or there may be investment of marital assets in the separate property so that the marital estate has a substantial stake in it.

In 2000, the concept of the “family use doctrine” made its appearance in Mississippi in the case of Brame v. Brame, 98-CA-00502-COA, ¶20 (Miss. App. 2000), in which the husband’s clock, piano and dining set, all of which had been gifted to him took on a “new personna [sic] of full family use,” and was converted from separate into marital property.

In Rhodes v. Rhodes, decided by the court of appeals on January 11, 2011, the court found that a Florida vacation home purchased by the husband three years before the marriage was converted into marital property under the family use doctrine based on the facts that: the wife engaged in “extensive efforts” in the property’s upkeep and maintenance; the wife “undertook efforts” to improve the property; the wife decorated the home on her own; the husband made payments on the home from his earnings through the marriage; the wife made contributions through deposits into a joint checking account; the wife contributed housekeeping efforts to the home; the wife and “her family” regularly vacationed and spent holidays there; the wife lived there for a considerable time and considered it her second home; and she and her daughter used it as a residence for “several months” after Hurricane Katrina. Rhodes at ¶ 36. The court held that as a result of the combination of factors, “the vacation home lost its character” as separate property of the husband. Thus, as of January 2011, the family use doctrine is alive and well.

On the facts of this case, with the many factors apparently supported by the evidence, it’s hard to quibble with the outcome. Most practitioners and trial judges grasp without any difficulty the equitable principles involved in finding a conversion from separate to marital when there has been financial investment of marital money and/or “sweat equity” in the property.

What gives most of us at the trial level pause, though, is the concept that an item may be converted from separate to marital property simply because it is used in the marriage by the family.

If I were a lawyer whose client just inherited a mortgage-free beach home in Gulf Shores and was concerned about the future of his marriage, would I not be wise to advise him under our current law: to prohibit any use of the property by his wife and children; and to pay all taxes and expenses of the property from entirely separate funds and not from any current income. Or what if the wife inherits an antique Baldwin grand piano from her aunt, would she not be best advised to store it where neither the husband nor the children could touch it and possibly convert it into marital property, even though the daughter has considerable musical skills and would benefit from its use?

Assuming I am correct about the above advice, how in the world does such a policy promote what is best for the family as a whole? Policy and its consequences often have a strong influence on people’s actions. Is this one of those unintended consequences we’ve talked about here before?

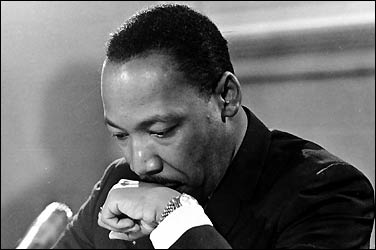

FREEDOM FOR ALL … OF US

January 16, 2011 § Leave a comment

January 15, 1929 – April 4, 1968

He fought to set us free from the bondage of racism.

Read his Letter from the Birmingham City Jail, annotated, here.

THERE ARE WORSE JOBS THAN BEING A LAWYER

January 14, 2011 § Leave a comment

CareerCast has rated 200 jobs for 2011, ranking them from best to worst. You can read the complete ranking here, and their methodology is here. The jobs are ranked and assigned an overall score using a combination of criteria, including salary, hiring outlook, stress, physical demands and work environment.

I’ve gone through the list and selected some jobs of interest to the legal profession, some directly law-related, and some purely for comparative purposes. The number in parentheses before each job title is the job’s rank. The number following each job title is the job’s stress factor, which I have included so that you can compare your profession’s to others.

The top three most desirable jobs are (1) Software Engineer 10.400, (2) Mathematician 12.780, and (3) Actuary 16.040.

The highest law-related job is (13) Paralegal 12.650. Next comes Court Reporter at (31) 18.560.

And another legal job does not show up until the 50’s, where Judge 21.390 pops up at (53).

(82) Attorney 36.110 is the next and last job of the legal-judicial field.

Some jobs rated above attorney are:

(10) Dental Hygienist 12.070

(18) Parole Officer 12.550

(32) Chiropractor 13.580

(68) Clergy 21.26

Some jobs rated lower than Attorney are:

(83) General Practitioner Physician 25.650

(92) Psychiatrist 24.420

(94) Registered Nurse 30.140

(101) Surgeon 16.32

(114) Senior Corporate Executive 47.4

(121) Commercial Airline Pilot 59.530

(140) Bartender 13.070

The worst three jobs are (198) Lumberjack 40.90, (199) Ironworker 31.270, and (200) Roustabout 26.430.

I did not find Chancery Clerk on the list. Does that mean that that job is ranked lower than 200 (Roustabout)?

It was no surprise to me that the stress level for Attorney is as high as it is, even higher than a general practice physician. But cleaning plaque from people’s gums and rooting around in their mouths is rated higher than any legal job? Sheesh.

INSOLVENT ESTATES

January 13, 2011 § 5 Comments

When the debts and expenses of the estate exceed the value of its assets, the estate is said to be insolvent, and there is a procedure for adjudication of insolvency, satisfaction of creditors, and payment of administration expenses that is spelled out in MCA § 91-7-261 through -268.

The estate is insolvent when its debts and the expenses of administration exceed the value of the real property and the other property that is not exempt. You can find out more about exempt property here.

Either the administrator or a creditor may petition the court to adjudicate its insolvency.

MCA § 91-7-261 sets out the procedure to determine insolvency. The administrator is required to “take proper steps speedily to ascertain whether the estate be solvent or insolvent.” If the administrator finds that the estate is insolvent, she files a “true account” itemizing all of the personal estate, assets of every description, the land of the deceased, and all of the deceased’s debts. Notice is given to the devisees or heirs, and the matter is presented to the court for hearing. If the court determines from the account that the estate is indeed insolvent, the chancellor will order that the assets be sold and that the expenses of ” … the last sickness, the funeral, and the administration, including the commissions …” are first paid out of the proceeds,” and that any remaining proceeds be divided among the creditors ” … in proportion to the sums due and owing them respectively …”

The procedure for distribution of remaining proceeds among the creditors is provided in MCA § 91-7-269. After the time to probate claims has elapsed, a notice is published for three consecutive weekss in a newspaper published in the county that the claims against the estate will be taken up by the court on a day and at a time certain, that any and all claims not required by law to be probated shall be filed with the clerk by a stated date, and that all creditors may attend. A hearing is held at which the administrator may object to any claim, evidence is presented pro and con, and the court may either allow it in whole or in part, or reject it in whole or in part. The administrator may file a verified application to be reimbursed for claims paid peior to the adjudication of insolvency, and the court shall treat them as if they had been properly probated.

MCA § 91-7-271 provides that the allowed claims shall be paid pro rata, and any creditor not paid within ten day of the court’s order shall have execution against the executor or administrator and the sureties on his bond.

Any suit pending against the executor or administrator at the time of insolvency does not abate, but may be prosecuted to final judgment, according to MCA § 91-7-273, but -274 bars suits from being filed after the estate is declared insolvent. You should read -273 carefully for the effect of and payment of a judgment against the estate for suits that were pending when the insolvency is determined.

UNDERSTANDING THE BEST EVIDENCE RULE

January 12, 2011 § 8 Comments

I would nominate MRE 1002 for second-most misunderstood rule of evidence (the all-time front-runner, without peer, would be the hearsay rule).

It’s fairly common to hear an exchange like this in court:

Atty 1: How much did you pay for the house?

Atty 2: Objection. The best evidence of what was paid would be the closing statement.

That objection and every one like it should be overruled.

MRE 1002 states:

To prove the content of a writing, recording or photograph, the original writing, recording or photograph is required except as otherwise provided in these rules or by law. [Emphasis added]

The rule only applies and requires the original when a party is seeking to prove the content of the original. Farris v. State, 906 So.2d 113, 115 (Miss. App. 2004). It does not apply simply because there exists a writing, recording or photograph that may be considered the “best” evidence of the matter.

The rule comes into play only when (a) the content of the writing, recording or photograph is itself the thing a party is trying to prove, or (b) a party is trying to prove a matter by using a writing, recording or photograph as evidence of it. The rule applies only when one seeks to prove the contents of the writing, photograph or recording so that they may be construed, and does not apply when one is seeking only to prove the existence of a writing, recording or photograph. Kinard v. Morgan, 679 So.2d 623, 625 (Miss. 1996).

An example of (a) would be where the party is trying to testify to the terms of a written contract. The contract itself would be the best evidence, and the original would need to be produced.

An example of (b) would be where the witness is testifying about the a claim based on an invoice that shows the items purchased, dates of purchase and prices. The original invoice would itself establish the claim and would be the best evidence of the transaction.

The rule would not apply to the following situations:

A witness with personal knowledge can testify about how much he earned in a pay period without producing the original pay records. Simply because written documents pertaining to a matter exist does not mean that a witness may not testify on personal knowledge about the matter. On the contrary, though, if the witness does not have personal knowledge and relies on documents for her information, she would be required to produce the original documents.

A witness may testify that a document exists without producing the original, but any testimony about the document’s content will require production of the original.

A person who heard another make a statement that was recorded may testify about what she heard without having to produce the recording.

The rule does not apply to physical evidence that is not writings, photographs or recordings. Riley v. State, 1 So.3d 877, 882 (Miss. App. 2008). In Riley, the appellant argued unsuccessfully that the State had violated the best evidence rule by not offering the original firearm involved in the crime into evidence.

The evidence qualifies as a “duplicate,” as defined in MRE 1001(4).

So here is the bottom line: A witness may testify on personal knowledge about a matter even if there is a writing, recording or photograph that documents the same thing, and the writing, recording or photograph need not be produced in such an event; but you must produce the original if you are trying to prove its content.

An important caveat: Just because you have satisfied MRE 1002 by producing the original does not in and of itself make that original admissible. The document or recording must still meet authentication and hearsay objections, and a foundation must be laid for admission of the photograph.

MRE 1004 provides some exceptions to the requirement for the original, such as loss or destruction of the original, original not obtainable, or original in possession of an opponent. Production of the original may also be dispensed with if the document, recording or photograph pertains only to collateral matters.

CORROBORATION PROBLEMS = DIVORCE PROBLEMS

January 11, 2011 § 3 Comments

I posted here about how crucial it is for the proof of grounds in fault-based divorces to be corroborated.

In Ladner v. Ladner, decided December 14, 2010, the court of appeals again emphasized the strength of the corroboration rule. The court stated at ¶ 10 the familiar principle that “The corroborated testimony must show conduct that ‘endangers life, limb, or health, or creates reasonable apprehension of such danger, rendering it impossible for [the other] spouse to discharge the duties of the marriage, thus destroying the basis for its continuance.'”

Deborah Ladner charged her husband Philip with habitual cruel and inhuman treatment She testified that Philip had been abusive toward her and assaulted her. She offered into evidence two police reports and two rpotective orders, which both the trial judge and the court of appeals found not to be corroborative because all of the information they contained was provided by Deborah. The appellate court also found uncorroborative a statement in a police report that the parties’ son was afraid of his father, and that Philp had broken his daughter’s door in anger because those showed only a troubled relationship with the children and did not corroborate Deborah’s testimony about violence directed at her. The court reversed the chancellor’s decision granting Daborah a divorce on the ground of habitual cruel and inhuman treatment.

Justice Carlton in her dissent would have found the testimony adequately corroborated to grant Deborah a divorce on habitual cruel and inhuman treatment. She quoted from Professor Bell’s treatise that the corroborating evidence need not be sufficient in itself to establish the ground, but only needs to be enough for the court to conclude that the plaintiff’s testimony is true.

An interesting twist in this case is that the chancellor granted both parties a divorce. He granted Deborah a divorce on the ground of habitual cruel and inhuman treatment, and he granted Philip a divorce on the ground of adultery. Philip had raised the issue that it was improper for the chancellor to grant dual divorces, but the court of appeals held that issue to be moot, based on its reversal of Deborah’s divorce.

There are several points chancery practitioners need to come away from this case with:

- No corroboration = no divorce. The requirement of corroboration is alive and well, and you need to be sure you have a corroborating witness or two lined up to support your case.

- Self-corroboration will not work. The information Deborah submitted to corroborate her claims that she generated was found not to be corroboration, and that makes perfect sense. It’s easy for a party to generate police reports and file charges to build a case. Those kinds of documents are nothing more than her own statements, so they corroborate nothing.

- The corroboration has to be linked to the conduct charged. Deborah’s proof about her son and daughter was not tied to conduct directed at her. Maybe the result would have been different if the son had testified that he was afraid of his dad because the son saw him threaten or physically mistreat the mom; if the door-breaking incident had been tied to a rampage in which Philip manhandled Deborah, that may have been the link she needed.

The easiest thing in the world is to tell your client, “Be sure to bring a witness to court who can back up your testimony about how he mistreated you.” That’s a ticket to failure, though. You need to investigate and identify who are the witnesses and what is the competent evidence that will make your client’s claim. It is no less important than discovering the value of that securities account or uncovering that hidden bank account.

“COURT HOUSE CLOSED”

January 10, 2011 § Leave a comment

That’s the sign on the door as I walked up this morning. Winter weather is to blame, although I zipped right into downtown with nary an icy patch to deter me.

The only advance notice we had of the closure was that “Only essential personnel should report to work.” Naturally, my ego would not let me admit to the possibility of non-essentiality. If only essential personnel did report, that’s scary because there are only three of us in the building. The entirety of Lauderdale County is a heavy load of responsibility for three people.

Oh, well, I guess I can find something to do here as well as I could at home.

For all the rest of you … enjoy your icy day.

BASQUE BRAISE LOUIS

January 9, 2011 § Leave a comment

If you were abducted by aliens and dumped blindfolded at the door of Louis’ Basque Corner, you would swear once inside that you were in the Faubourg Marigny in New Orleans in one of those gritty, working-class neighborhood hangouts where leathery topers linger over drafts in the front saloon and families enjoy incredible cuisine in the back dining rooms. There’s a smoky haze that clings to the mismatched, outdated furniture and the souvenirs left behind by satisfied customers. Ray Charles wails on the juke box, and there is a happy chattery buzz punctuated by a raucous laugh from time to time.

The thing is, Louis’ is in Reno, Nevada, of all places, on a side street blocks away from the glittery casinos and showplaces. It’s the renowned restaurant of Louis and Lorraine Erreguible, who will serve you delectable Basque specialties from that region of the Pyrenees between Spain and France. Here’s a video of Guy Fieri of the Food Channel at Louis’ that will give you an idea of the quality of the cuisine as well as the simple ambience.

The thing is, Louis’ is in Reno, Nevada, of all places, on a side street blocks away from the glittery casinos and showplaces. It’s the renowned restaurant of Louis and Lorraine Erreguible, who will serve you delectable Basque specialties from that region of the Pyrenees between Spain and France. Here’s a video of Guy Fieri of the Food Channel at Louis’ that will give you an idea of the quality of the cuisine as well as the simple ambience.

This braise recipe creates a sauce that is a base for any number of departures. You can use it to cook chicken seasoned with tarragon and sage and mushrooms, or lamb with rosemary, or rabbit with fennel. I had sweetbreads cooked in this sauce, and they were divine. Experiment with your own taste buds. I have tweaked this recipe from versions I found on the internet. As with all braises, you should tweak it your way and make it your own.

And if you’re ever in Reno, be sure to experience Louis’.

BASQUE BRAISE LOUIS

½ Cup vegetable oil

1 ½ Lb. meat of your choice (chicken, lamb, rabbit or any other suitable meat)

Salt and pepper

3 Medium onions, chopped

2 Green bell peppers, chopped

4 Carrots, sliced

2 Stalks celery, sliced

6 Cloves garlic, minced

2 Shallots, minced

¼ Tsp. red pepper flakes

2 Cans (24 0z.) whole tomatoes

½ Tbsp. flour

2 Cups dry white wine and more as needed

Seasonings of your choice for the meat

Salt and pepper to taste

Preheat oven to 350 degrees.

In a large braising pan, heat oil over medium high heat until a clean wooden spoon inserted in it bubbles. Season the meat with salt and pepper and brown on all sides. Remove the meat from the pan and set aside.

Add onions, bell pepper, carrots, celery, garlic and shallots to the oil and sauté until wilted.

Add tomatoes and pepper flakes, and cook on medium high heat for 5 – 10 minutes.

Sprinkle the flour and mix in as a roux. When the flour is well blended, add the white wine and bring just to a boil. Reduce the mixture on low heat or place in the oven until sauce has thickened to a tomato-paste consistency. Remove from stove or oven.

Season the meat with the seasonings of your choice, add the meat to the sauce mixture, and stir in. Cover and return to oven, stirring occasionally. Add wine as necessary to keep moist. Bake 1 to 1 ½ hours or until meat is tender.

STUNG TO DEATH BY SINGLE BEES

January 7, 2011 § Leave a comment

He got into a restless habit of strolling about when the cause was on, or expected, talking to the little shopkeepers, and telling ’em to keep out of Chancery, whatever they did. ‘For,’ says he, ‘it’s being ground to bits in a slow mill; it’s being roasted at a slow fire; it’s being stung to death by single bees; it’s being drowned by drops; it’s going mad by grains.’

— from Bleak House, by Charles Dickens

LEGAL REASONING RUN AMOK

January 7, 2011 § 5 Comments

This is a faux Canadian appellate case that I remember studying in law school and ran across recently. It was actually written by a law professor as a parody of legal reasoning, but, scarily, it could easily be mistaken for the real thing.

IN THE SUPREME COURT

REGINA

V.

OJIBWAY

Blue, J. August, 1965

This is an appeal by the Crown by way of a stated case from a decision of the magistrate acquitting the accused of a charge under the Small Birds Act, R.S.O., 1960, c. 724, s. 2. The facts are not in dispute. Fred Ojibway, an Indian, was riding his pony through Queen’s Park on January 2, 1965. Being impoverished, and having been forced to pledge his saddle, he substituted a downy pillow in lieu of the said saddle. On this particular day the accused’s misfortune was further heightened by the circumstance of his pony breaking its foreleg. In accord with Indian custom, the accused then shot the pony to relieve it of its awkwardness. The accused was then charged with having breached the Small Birds Act, s. 2 of which states: “2. Anyone maiming, injuring or killing small birds is guilty of an offence and subject to a fine not in excess of two hundred dollars.” The learned magistrate acquitted the accused holding, in fact, that he had killed his horse and not a small bird. With respect, I cannot agree.

In light of the definition section my course is quite clear. Section 1 defines “bird” as “a two legged animal covered with feathers.” There can be no doubt that this case is covered by this section.

Counsel for the accused made several ingenious arguments to which, in fairness, I must address myself. He submitted that the evidence of the expert clearly concluded that the animal in question was a pony and not a bird, but this is not the issue. We are not interested in whether the animal in question is a bird or not in fact, but whether it is one in law. Statutory interpretation has forced many a horse to eat birdseed for the rest of its life.

Counsel also contended that the neighing noise emitted by the animal could not possibly be produced by a bird. With respect, the sounds emitted by an animal are irrelevant to its nature, for a bird is no less a bird because it is silent.

Counsel for the accused also argued that since there was evidence to show accused had ridden the animal, this pointed to the fact that it could not be a bird but was actually a pony. Obviously, this avoids the issue. The issue is not whether the animal was ridden or not, but whether it was shot or not, for to ride a pony or a bird is of no offence at all. I believe counsel now sees his mistake.

Counsel contends that the iron shoes found on the animal decisively disqualify it from being a bird. I must inform counsel, however, that how an animal dresses is of no consequence to this court.

Counsel relied on the decision in Re Chicadee, where he contends that in similar circumstances the accused was aquitted. However, this is a horse of a different colour. A close reading of that case indicates that the animal in question there was not a small bird, but, in fact, a midget of a much larger species. Therefore, that case is inapplicable to our facts.

Counsel finally submits that the word “small” in the title Small Birds Act refers not to “Birds” but to “Act”, making it The Small Act relating to Birds. With respect, counsel did not do his homework very well, for the Large Birds Act, R.S.O. 1960, c. 725 is just as small. If pressed, I need only refer to the Small Loans Act, R.S.O. 1960, c. 727 which is twice as large as the Large Birds Act.

It remains then to state my reason for judgment which, simply, is as follows: Different things may take on the same meaning for different purposes. For the purpose of the Small Birds Act, all two-legged, feather-covered animals are birds. This, of course, does not imply that only two-legged animals qualify, for the legislative intent is to make two legs merely the minimum requirement. The statute therefore contemplated multi-legged animals with feathers as well. Counsel submits that having regard to the purpose of the statute only small animals “naturally covered” with feathers could have been contemplated. However, had this been the intention of the legislature, I am certain that the phrase “naturally covered” would have been expressly inserted just as “Long” was inserted in the Longshoreman’s Act.

Therefore, a horse with feathers on its back must be deemed for the purposes of this Act to be a bird, and a fortiori, a pony with feathers on its back is a small bird.

Counsel posed the following rhetorical question: If the pillow had been removed prior to the shooting, would the animal still be a bird? To this let me answer rhetorically: Is a bird any less of a bird without its feathers?

Appeal allowed.